Christina Seibert

Cathode ray tube (CRT) glass composes the largest portion of the U.S. e-waste stream according to a 2011 report released by EPA. These tubes are found in older model televisions and computer monitors. Recycling of CRTs into new CRTs has been the most common management method. However, having become obsolete through the popularity of flat screens, the market for new CRTs is dwindling dramatically. The result is an industry plagued by high profile bankruptcies and abandoned warehouses of stockpiled CRT glass, leaving property owners and state or federal agencies to pick up the costly pieces (see Figure 1).

There are only a few operations in which recovered CRT glass may be used to produce new CRT glass—none of which operate in the U.S. Moreover, the implementation of CRT disposal bans in 19 states and e-waste program laws in 25 states have resulted in significant quantities of CRTs being collected, where they historically may have been disposed in landfills. With CRT stockpiles mounting nationwide, the pressure is only increasing on electronics manufacturers and States to prevent further dead-end scenarios. Today, the CRT challenge is so large that California recently announced emergency regulations to allow for the disposal of residual CRT glass in hazardous waste landfills if recyclers cannot find a suitable reuse for the glass. The urgency to pursue a short-term solution to CRT recycling is critical to the viability of the e-waste industry.

Due to limited capacity currently available at existing CRT glass processors, demand for less expensive processing costs, and social and environmental implications, there are many layers to consider in this recycling dilemma. The recent white paper entitled An Analysis of the Demand for CRT Glass Processing in the U.S diligently examines these various layers, as well as a new CRT recycling solution that takes a novel approach to the challenge that is expected to cost 40 percent less than conventional approaches.

Scope of CRT Challenge

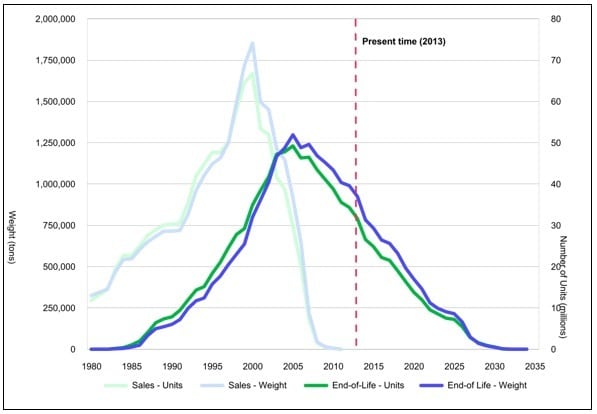

In total, an estimated 6.9 million tons of CRT devices will require management from 2013 to 2033. Using the historical sales data for CRT devices, EPA developed a model to estimate annual quantities of CRT devices (and other components of the e-waste stream) reaching their “end-of-life,” at which point the CRTs would be collected for recycling or disposal. Based on end-of-life calculations contained in the EPA model, all computer monitors containing CRTs are projected to reach end-of-life by 2023 and televisions by 2033.

If all CRTs projected to reach end-of-life are recovered for recycling (i.e., 100 percent recovery), the annual quantity of CRTs recovered would range from 925,000 tons in 2013 to 280,000 tons in 2022, ultimately dropping to 0 in 2033.

Assuming a 50 percent overall CRT recovery rate, over the next 10 years (2013 – 2022) an average of 206,000 tons per year of CRT glass would need to be recycled. Compared to the estimated capacity of the four current CRT glass North American processors, there is an apparent shortfall in capacity of 78,000 tons per year, even assuming that all of the capacity was made available to U.S. recyclers. This capacity shortfall, dubbed the ‘glass tsunami,’ may explain recent reports of CRTs being stockpiled and the subsequent bankruptcies of several recyclers (see Figure 2).

Unfortunately, existing processing facilities do not provide sufficient capacity to manage the quantity of CRTs being recovered currently nor over the next 10 years. There are only four CRT glass processing facilities operating in North America, with only one operating in the U.S. Notably, these facilities are located in the far Northeast, far Northwest and far Southwest relative to the Continental United States, which means that CRT glass must be transported long distances to a glass processing facility. Only the Doe Run facility in Missouri is centrally located within the U.S.

Wrestling with Processing Costs

In addition to the limited capacity currently available at existing CRT glass processors, the rising cost of processing is an increasing concern. Processing costs are cited by a number of agencies (e.g., U.S. International Trade Commission, Transparent Planet and Wisconsin Department of Natural Resources) as a reason for collected CRTs being stockpiled. CRTs are generally more costly to process than other components of the e-waste stream because of the cost incurred to manage the CRT glass.

Processing costs at existing and proposed CRT glass processors generally range from $0.07 to $0.12 per pound, with most proposed facilities having costs at the higher end of this range, indicating that the cost to process CRT glass in the future will be at least as high as it is currently. Additionally, though development of new facilities may reduce transportation distances, the limited number of CRT glass end-use markets will continue to present challenges for recyclers.

Electronics manufacturers (OEMs) are reportedly reducing funding for e-waste recycling on a unit basis (price per pound), which may not be sufficient to cover the costs of CRT recycling now or in the future. In States where OEMs are responsible for funding a portion of recycling efforts through e-waste program laws and meeting an annual recycling goal, more e-waste may be collected than the OEMs are required to fund, further straining those declining funds.

Adding New Processing Capacity

In response to the decline in historical markets for CRT glass, several new processing options are currently being proposed. Three companies are seeking to develop new glass processing furnaces to separate lead from the glass and provide feedstock for production of new glass products. Closed Loop Refining and Recycling has proposed two glass furnaces in Arizona and Ohio. Regenesys Glass Processing has proposed a glass furnace in Texas and NuLife Glass has proposed a glass furnace in New York.

The four new facilities proposed for development may ultimately provide an additional 198,000 tons of domestic CRT glass processing capacity. Three of the facilities are in the permitting phase, and one facility is under construction. However, development of new processing capacity requires significant leadtime to identify a suitable site location, secure necessary permits and construct facilities, not to mention significant investment capital. It is suspected that CRT stockpiling is a result of collectors storing CRTs in the hope that a cost competitive solution will emerge before the one-year limit on holding the hazardous material runs out.

Environmental Implications of Primary Processing Methods

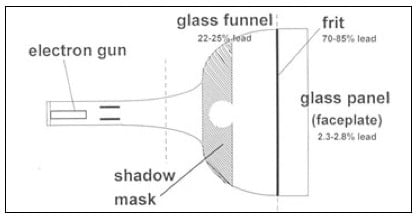

The current primary methods of CRT glass processing are glass-to-glass recycling and secondary lead smelting. Due to the lead content, there are potential environmental impacts associated with the recycling of CRTs and other electronic devices, hence their hazardous material designation.

An EPA background report on processing of CRTs for glass-to-glass recycling identified public health and environmental impacts that may arise from a number of steps in the glass-to-glass process, including airborne lead and particulate matter, leaded washwater and slag, among others. The EPA also points to the shipment of CRT glass as generating transportation-related emissions.

Secondary lead smelters process lead-containing materials to recover the lead for reuse through an energy-intensive process. During this, materials are heated to a high temperature that results in air emissions that must be managed. Some airborne lead emissions may ultimately settle on the ground and in surface water. Smelters also generate slag as a by-product of the lead recovery process, which is often characterized as hazardous waste.

Like smelters, landfills are subject to federal and state regulation. When CRTs are placed in landfills (which is still allowed in many states), the primary environmental pathway for leachable metals is groundwater, which is protected by the landfill liner and leachate collection system.

SWANA completed a municipal waste landfill research study in 2004 which specifically including a review of lead leachability from CRT glass. It pointed to previous study, performed by the University of Florida in 1999, that measured the leachable lead content of mixed, broken CRT glass using the TCLP. It found that the lead concentration of the glass averaged 18.5 mg/L, well above the federal regulatory lead threshold of 5 mg/L (above which material is designated a hazardous waste). The SWANA study went on to detail findings from other additional studies to demonstrate that, under actual landfill conditions, the concentration of lead leached from CRT glass would be lower than indicated by laboratory TCLP results.

The SWANA study concluded that “MSW landfills can provide for the safe, efficient, and long-term management of disposed products containing RCRA heavy metals without exceeding limits that have been established to protect public health and the environment,” containing them at levels that “protect public health and the environment for extremely long periods of time, if not forever.”

A Pivotal Point for CRT Processing

Based on this information from EPA and SWANA, management of CRTs through a process that renders the lead virtually un-leachable and uses the end product as Alternative Daily Cover (ADC) in landfills can be viewed as a pivotal moment in the drama of the ‘glass tsunami.’ The process provides a recycling option that is in demand for the processed CRT glass and at a significantly reduced cost.

Landfill operators must cover all disposed solid waste at the end of each day to control odors, vectors, fires, litter and scavenging. While federal regulations require landfill operators to use six inches of earthen materials as daily cover, alternative materials in lieu of earthen materials to cover waste at landfills are also recognized. These materials are referred to as ADC.

Using alternative materials recycled as ADC provides value by preserving clean soil excavated during landfill construction to be used for other commercial purposes. Beneficial use of many materials, such as foundry sand, shredded tires, and wood chips as ADC, is recognized as recycling or diversion by a number of states.

A process to treat crushed CRT glass, stabilize the lead to prevent leaching, and beneficially use the treated material as ADC to support operation of a municipal waste landfill has been developed and permitted by Peoria Disposal Company (PDC) in Illinois. This novel methodology proposes a new end-use market and additional CRT glass processing capacity that will serve the U.S. for decades.

The treatment and beneficial use of CRT glass by PDC provides access to an additional, domestic CRT glass processing facility and end-use market, at a cost up to 40 percent less than conventional methods. Beneficial use of treated CRT glass, in conjunction with other existing and proposed processing facilities discussed previously, will help to address the immediate and long-term demand for CRT glass processing (see Case Study sidebar).

Looking Forward

Although recovery and processing of CRT glass may result in increased quantities of glass and lead available for use in other products, the quantities recovered represent a relatively small fraction of the lead and glass recovered through other recycling processes. Additionally, there are capacity, transportation and other challenges associated with recovering these materials from CRTs. The current capacity shortage and subsequent CRT stockpiling is leading the e-waste recycling industry into a downward spiral.

Using treated CRT glass as ADC provides an environmentally and socially sound option that offers an additional end-use market that provides a dual purpose: preserving virgin soil, while also creating an answer to the CRT glass recycling problem. The time has come for the industry to pivot toward this new, beneficial direction.

Christina Seibert is a Project Manager and Solid Waste Planner with CB&I, Inc. (St. Charles, IL). She is responsible for performing technical and economic feasibility analyses for diversion and disposal alternatives, conducting market assessments, developing local and regional solid waste management plans, and developing and facilitating education and outreach strategies related to the management of all types of resources on behalf of both public sector and private sector entities within CB&I’s Solid Waste Services group. For more information, e-mail [email protected].

Figure 1

CRT components.

Image courtesy of Florida Department of Environmental Protection, Bureau of Solid and Hazardous Waste.

Figure 2

CRT Devices: Annual Sales and End-of-Life Management Projections (1980-2033)

Image courtesy of U.S. EPA, Electronics Waste Management in the United States through 2009, May 2011.

Case Study

Kuusakoski Recycling Treated CRT Glass for Beneficial Use as Landfill Alternative Daily Cover

For more than 85 years, environmental services firm Peoria Disposal Company (PDC) has provided a wide range of waste management services, including hazardous waste transportation, treatment and disposal. From 1989 to 1998, PDC accepted crushed CRT glass from Zenith Electronics’ manufacturing facility for treatment and disposal at its PDC Landfill No. 1 Facility in Peoria, IL.

Kuusakoski Recycling partnered with PDC in 2012 to find a beneficial use for Kuusakoski’s treated CRT glass in the US. The collaboration resulted in the KleanKover Recycling Solution, recently announced this year at E-Scrap. PDC filed a provisional patent application for the CRT glass treatment technology and a service mark application for the CRT glass treatment process, KleanKover (the treated CRT glass product), in July 2013.

How It Works

Crushed leaded or mixed CRT glass from Kuusakoski’s Peoria recycling facility (which accepts both whole and dismantled CRTs) is delivered to PDC’s Waste Stabilization Facility. The facility is permitted to receive and treat CRT glass and is currently operational.

Crushed glass is placed in a mixing unit until the size is reduced to 2” or less. A proprietary chemical treatment reagent blend is then introduced. Adding water facilitates rapid and thorough ingredient blending, initiating the chemical reaction treating the heavy metals present in the CRT glass.

The resulting material is permanently stable. Every batch is tested in the PDC laboratory to ensure the lead is non-leachable. PDC tests the KleanKover to see that it is unaffected by acidity, alkalinity, extreme heat and extreme cold, ensuring that it passes the Land Disposal Restriction treatment standard for lead in Illinois. With compliance confirmed, the batch of treated CRT material is removed from storage and shipped to PDC’s permitted municipal solid waste landfill in neighboring Tazewell County, Indian Creek Landfill, to be used beneficially as ADC.