The low return currently being provided by the bond market is just one of the contributing factors to the hard insurance market. Limited capacity, because of items such as the return on investments is another. With less capacity, the carriers are charging more for the coverage. It is not uncommon for companies to pay the same premium at their renewal this year as they paid for twice as much coverage last year.

By Nathan Brainard

The first part of this article, “Salting the Insurance Wound” was published in Waste Advantage Magazine’s September 2019 issue and gave an overview of what is going on in the insurance marketplace, specifically addressing the hardening market (https://wasteadvantagemag.com/salting-the-insurance-wound/). Since the publication of that article, the insurance market has continued its downward trend. First a quick recap.

What is a “Hard” Insurance Market?

In very simple terms, a hard insurance market occurs when premiums go up and capacity goes down. It is important to realize that the same way your company buys insurance, so do the insurance carriers. Insurance carriers buy their coverage from the reinsurance market. As you might imagine, there are a finite number of reinsurance markets available for the insurance carriers to work with and these agreements are renewed on an annual basis. Generally, reinsurers are impacted by catastrophic events such as the wildfires in California, flooding in the Central and Southeastern states, hurricanes, etc. As those losses are paid and the overall cost of those claims are calculated, the reinsurers determine how much capacity they are willing to put forward for the coming year and how much they are going to charge for the offered capacity. If they were hammered by losses, they are going to try and make up the deficit by charging a higher rate and offering less coverage to reduce their overall exposure. This causes the market to tighten as the insurance carriers your company works with are now paying a higher premium for their protection. They have less capacity to offer, which drives up the premiums they charge and forces them to be much more selective on where they want to offer terms. This is where the insurance industry is currently positioned.

Insurance Carrier’s Investment Approach

There are a number of factors related to the market hardening in the manner it has beyond those in the previous article. One of the primary contributors to the escalated premiums has to do with how the insurance carriers invest the premiums they collect.

When your company pays premiums, those funds are collected and invested by the carrier, typically in two-year or 10-year treasury bonds. A little over a year ago, the average rate of return on a 10-year bond was around 3.25 percent. As of the writing of this article, these same bonds have a yield rate under 1 percent, which is unprecedented. With the yield being so low, carriers are being forced to increase their premiums to have enough money to payout claims and incurred settlements. This, of course, is in addition to their escalated costs of reinsurance, which they are passing on to the policyholder.

In his recent letter to shareholders, Berkshire Hathaway’s Chairman of the Board, Warren Buffet, stated, “One reason we were attracted to the P/C business (Property & Casualty) was the industry’s business model: P/C insurers receive premiums upfront and pay claims later. In extreme cases, such as claims arising from exposure to asbestos, or severe workplace accidents, payments can stretch over many decades.”

“This collect-now, pay-later model leaves P/C companies holding large sums—money we call “float”—that will eventually go to others. Meanwhile, insurers get to invest this float for their own benefit. Though individual policies and claims come and go, the amount of float an insurer holds usually remains fairly stable in relation to premium volume. Consequently, as our business grows, so does our float. If our premiums exceed the total of our expenses and eventual losses, our insurance operation registers an underwriting profit that adds to the investment income the float produces. When such a profit is earned, we enjoy the use of free money—and, better yet, get paid for holding it.”

“For the P/C industry as a whole, the financial value of float is now far less than it was for many years. That’s because the standard investment strategy for almost all P/C companies is heavily—and properly—skewed toward high-grade bonds. Changes in interest rates, therefore, matter enormously to these companies, and during the last decade the bond market has offered pathetically low rates.”

“Consequently, insurers suffered, as year by year they were forced—by maturities or issuer-call provisions—to recycle their “old” investment portfolios into new holdings providing much lower yields. Where once these insurers could safely earn 5 cents or 6 cents on each dollar of float, they now take in only 2 cents or 3 cents (or even less if their operations are concentrated in countries mired in the never-never land of negative rates).”

“Some insurers may try to mitigate their loss of revenue by buying lower-quality bonds and activities that most institutions are ill-equipped to play.”1

The low return currently being provided by the bond market is just one of the contributing factors to the hard insurance market. Limited capacity, because of items such as the return on investments is another. With less capacity the carriers are charging more for the coverage. It is not uncommon for companies to pay the same premium at their renewal this year as they paid for twice as much coverage last year.

Social Responsibility Mentality

Another issue insurance carriers and policy holders are facing is known as Social Responsibility. This term started gaining traction towards the last half of the 2019 calendar year. In short, Social Responsibility as defined by Wikipedia is, “An ethical framework and suggests that an entity, be it an organization or individual, has an obligation to act for the benefit of society at large. Social responsibility is a duty every individual has to perform so as to maintain a balance between the economy and the ecosystems.” This is a concept the Millennial Generation is embracing wholeheartedly and is witnessed in recent jury verdicts. These verdicts are sometimes referred to as Nuclear Verdicts because of the massive awards being issued.

In the most recent issue of The Hales Report (an insurance related publication), Issue #4, Vol 3 released on February 19, 2020 there is an article about a trucking company who was on the wrong end of an $89,000,000 Social Responsibility verdict even though the facts of the case appear to be in their favor. One of the company’s drivers was found liable simply for operating at the time of inclement weather, when a separate vehicle crossed a median and struck the tractor-trailer head on. Tragically, a seven-year old boy died, a 12-year old girl was rendered a quadriplegic and two others sustained serious injuries. But the company’s driver was going 25 miles below the speed limit, in full control of the vehicle, and was found to have reacted “very quickly” and “appropriately” (the company’s driver was not even issued a traffic citation). There has long been a sentiment among company owners that, “the big truck always loses.” Awards such as this seem to support and amplify the sentiment. Further, this outcome now raises the question of whether a company becomes liable for simply being in the proximity of the accident even if they can prove they did nothing wrong.

While this trucking company intends to fight this verdict, it is outcomes such as these that will continue to push insurance premiums higher and higher and drive carriers out of certain market segments (such as heavy auto) as they feel they cannot make a profit or get a feel for the sort of awards juries and courts may award.

For a number of years, the Umbrella market felt pretty secure in their underwriting habits and how they evaluated risk factors before offering terms of coverage. With this new Social Responsibility mentality, they are now having to reevaluate how they are measuring risk in an effort to make sure they are charging enough premium to cover the exposures they take on. In years’ past, you may have had a claim that pierced into the Umbrella layer once in a rare while. In today’s society, it is happening much more frequently, and the payouts involved are often in excess of their limit, making the situation more complex and outing the policyholder on the hook for any uncovered sums awarded.

Market Impact

One of the most heavily impacted lines of coverage in the current market situation has been the Umbrella or Excess coverage as we just discussed. With outcomes such as the one the trucking company in the example is facing, more and more Umbrella policies are being impacted with reserves (money the insurance carrier sets aside in anticipation of where the claim could finally settle) and in fully paid claim resolution. This impact has caused premiums to skyrocket while at the same time has substantially reduced available capacity.

Whereas companies in the past may have carried $10,000,000 in excess coverage all with one carrier, they are now forced to use multiple carriers to achieve this same limit, and the cost can be anywhere from 30 percent to 200 percent more than the expiring premium based on exposures and claims history. Many companies are now carrying lower limits due to the excessive cost. Clearly this is a precarious situation with verdicts being handed out in such large sums. Company owners want to protect themselves, but at a certain point it becomes financially unviable and tough decisions must be made such as how much coverage can be afforded versus how much coverage is needed to provide peace of mind. Currently the two do not align, which builds frustration for the policy holders.

The frustration is further felt on policy lines for auto, specifically heavy and extra heavy auto units. Anyone operating vehicles categorized in this segment is well aware of what the rates have been doing the past few years. Sadly, there does not appear to be any relief in sight. The sentiment within the insurance industry is that sooner or later a leveling off will happen, but no one knows when this might occur. As long as we continue to have Nuclear Verdicts such as the one described previously, the timeline will continue to be pushed back as carriers must determine how to best prepare and account for these judgements.

While Commercial Auto and Umbrella coverages are the most volatile lines currently, we are also seeing issues surrounding the property market. Companies with a large natural catastrophe exposure such as businesses with coastal exposure (Florida, Louisiana, etc.), or those in areas with exposure to other natural disasters like tornadoes (the Midwest) or wildfires (California) are also seeing rates increase and capacity dwindle. When you add in industry specific issues, such as lithium ion batteries for the waste and recycling sector you have another serious pain point for company owners.

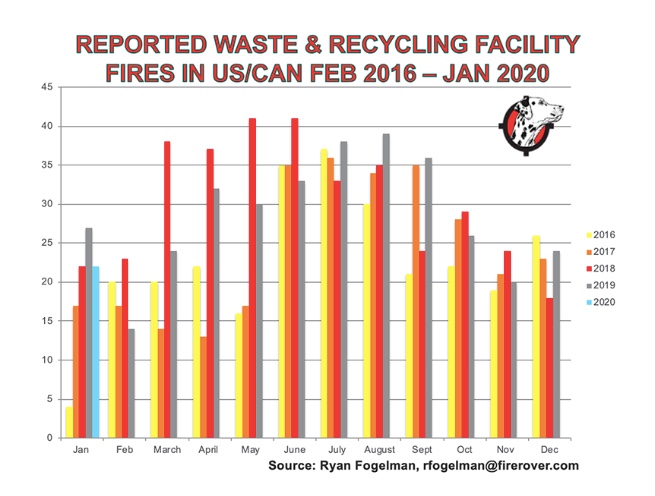

By the very nature of the industry, waste and recycling companies tend to have material onsite that is highly flammable (paper, cardboard, plastic, solvents, chemicals, etc.), many of which may be hidden within the waste stream. While the industry works extremely hard to educate the general public as to what is and is not acceptable to put in their garbage or recycling bins at home, not everyone is paying attention or, for that matter, seems to care. It is the inclusion of these materials that present a greater risk elevation to both the facility owner and the insurance carrier. Figure 1 is a chart of the reported waste and recycling facility fires from 2016 through January 2020 per Ryan Fogelman of Fire Rover, LLC.

As you can see, some months are better than prior years while others have seen the pendulum swing negatively in the other direction. It is not unwarranted to expect property insurance carriers to begin layering their coverage offerings with other carriers in an effort to both minimize their exposure on any one property schedule and maximize the reduced capacity they have available much the same way we are seeing Umbrella carriers do. As a reminder, layering is when you have multiple carriers participate in the overall total coverage limit with each carrier taking a portion of the overall risk.

Where Do We Go From Here

There has not been much, if any good news out of the insurance market in the past 18 months or so, and sadly it appears this will remain the status quo for the foreseeable future. Company owners are going to have to make some hard decisions moving forward. While the larger companies will have a few more options available to them, it is the mid-size and small family run companies who will be the hardest hit.

Many family run operations and mid-size companies are not able to take the financial risk larger companies can tolerate (think per occurrence deductibles or retentions of $250,000 or more). Further, because of the premium involved in a larger company, they will have more suitors/ options available to them. As such, it is safe to expect a fair amount of merger and acquisition activity in the 2020 calendar year as those who are struggling to make ends meet will look to cash out. Further, election years always seem to have a flurry of activity as no one knows how a political change will impact a company from available workforce to taxes and everything in between.

For those companies who are determined to withstand the storm and continue on, you should plan to meet with your insurance advisor on a regular basis to have the most up-to-date information on market conditions. Premiums are going up, and you will want to make sure you head into your renewal with realistic expectations. You should also discuss options to help mitigate anticipated increases in premiums. This could be accomplished in several ways, such as: adding or increasing deductibles, removing physical damage on older vehicles in your fleet, and potentially self-insuring some aspects of your exposure that are currently protected via risk transfer to the insurance carrier via the insurance policy.

Every situation is going to be different and the risk threshold for each company will also vary. The current insurance marketplace will make things financially difficult for those who are not willing or able to put more skin in the game and it is realistic to expect those to be the hardest hit in terms of premium in the next renewal cycle. | WA

Nathan Brainard, AAI, is Vice President of the Environmental Division at Insurance Office of America (IOA) (Longwood, FL) and is the endorsed insurance partner of the NWRA. Nathan has been with IOA for 15 years and specializes in Environmental Insurance with an emphasis on insurance for the Waste, Recycling, Remediation and Demolition industries. He can be reached at (407) 998-5287 or via e-mail at [email protected].

Note

1. A full copy of Mr. Buffett’s letter to stockholders can be found via this link: https:// fm.cnbc.com/applications/cnbc.com/resources/files/2020/02/22/2019ltr.pdf