As demand for recycling grows, a waste company must demonstrate economic profits throughout a commodity cycle before it can claim recycling as a true moat-building competitive advantage.

Barbara Noverini

Growth in recycling has not enhanced industry-wide profitability. Landfill owners historically enjoyed pricing power by controlling access to a necessary asset. However, the value proposition has changed now that recycled trash is perceived to have actual value. A fundamental shift in the economics of the waste industry is underway.

At Morningstar, we always start our equity research process by reviewing a company’s competitive strengths and weaknesses and assigning an economic moat rating. As investors, we strive to find companies with narrow or wide economic moats—defined as a set of competitive advantages that protect sustainable economic profit generation for extended periods of time. In the recycling value chain, we believe that limited pricing power and a finite ability to reduce costs present obstacles for economic moat development. As such, recycling contributes to a moat-building competitive advantage only if offering the service protects a waste company’s ability to command higher prices, sustainably operate at a lower cost, or both.

In Competitive Situations, the Addition of Recycling Can Stress Existing Moat Sources

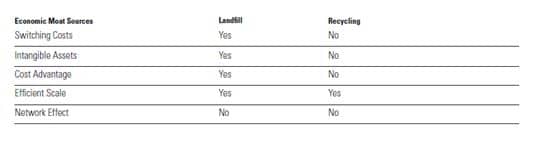

There are five different economic moat sources (see Figure 1, page xx), which we discuss in the context of recycling, below. We’ve long maintained that landfill owners derive pricing power from a combination of intangible assets (regulatory permits), switching costs and efficient scale. In addition, vertical integration can develop cost advantages through economies of scale. Yet, we suspect that adding recycling to a vertically integrated disposal system can actually strain these moat sources, rather than enrich them. Recycling increases the cost of execution without securing the ability to sustainably command premium pricing. As such, pinning a moat source directly on recycling remains a challenge.

Efficient Scale

An efficient scale exists when a limited market is effectively served by one or a small handful of companies. Thus, “first-mover advantage” can define a recycling strategy, as an upstart recycler might have to compete recyclables away from an incumbent’s waste stream by offering irrationally high customer rebates. When an incumbent achieves a balance between capacity and demand in its local market, we believe the establishment of efficient scale can serve as a barrier to entry. This relationship may have the ability to affect downward pressure on customer rebates over time, allowing the incumbent to capture more value from commodity sales.That said, the incumbent’s advantage of capturing a considerable portion of the market’s recyclables is actually “borrowed” from the collection network originally established to serve the landfill. Therefore, justification for assigning this moat source to recycling on a standalone basis is debatable.

Low Cost Advantage

Adding recycling to a vertically integrated disposal system increases costs without creating commensurate ability to influence price anyplace else along the value chain. A higher proportion of variable costs limit operating leverage at materials recovery facilities (MRFs) relative to landfills, implying less opportunity to achieve the scale necessary to develop a low cost advantage. MRF operators may be able to capture additional value relative to peers by controlling processing costs, but operating efficiency doesn’t necessarily imply a scale advantage, either.

Intangible Assets

Regulatory permits for landfill ownership comprise one of the strongest competitive advantages in the disposal industry, erecting strong barriers to entry and providing the kind of pricing power afforded to a gatekeeper. Acquiring permission to build a MRF doesn’t develop the same magnitude of pricing power because recyclable values are dictated by commodity markets. Whereas the only landfill in town can (theoretically) charge any price to provide an essential service, permitted-MRF operators must still purchase recyclables from customers and sell them before any additional value is gained. Although there is greater opportunity for upside when commodity markets are booming, this doesn’t match Morningstar’s definition of a long-term competitive advantage.

Switching Costs

Using the landfill as an anchor, recycling is often added to a vertically integrated system in an attempt to control the entire waste stream in any given area. Theoretically, this increases customer switching costs by rolling up essential services into one master contract, heightening the customer’s reliance on the waste company. However, we’d argue that this bundling is often given to the customer at a discount, especially in markets where municipal disposal costs are cheap. Furthermore, absent regulations mandating recycling, we’re not convinced that it is truly an essential service. Rather, recycling is a more expensive way to compete for customer retention.

Network Effect

This moat source describes a virtuous circle, wherein every additional user strengthens the overall value of a network. Recycling operators can theoretically play a role in creating end markets by gathering enough recyclables for manufacturers to cost-effectively use as raw materials in the production of goods. Waste generators benefit by receiving rebates for the trash used in this process. In essence, recycling facilitates a closed-loop exchange of value that increases with every addition of a waste generator or a goods manufacturer willing to use recyclables as inputs. However, this situation would more likely create downward pricing pressure on commodities as supply becomes more abundant. In our opinion, the level of investment required to establish a network effect wouldn’t be met with a commensurate level of premium pricing power, making this economic moat source unlikely.

Porter’s Five Forces Point to Structural Profitability Constraints in the Recycling Industry

A look at a hybrid recycling-disposal value chain through the analytical lens of business strategy guru Michael Porter’s Five Forces competitive analysis framework supports our belief that recycling lacks an economic moat. In our opinion, each industry-level force describes a fairly intense challenge to recycling profitability, especially when compared with those acting in the disposal industry alone.Furthermore,integrating these two disparate services appears to create a dependency, with recycling leveraging the superior competitive positioning of the landfill to compensate for its own structural weaknesses.

Buyer Power

Adding recycling to the waste stream shifts negotiating power in the buyer’s favor.In the disposal model, landfill owners command most of the negotiating power by controlling access to a necessary asset.However, when trash is viewed as a commodity rather than something to discard, buyers will undoubtedly demand more of its value for themselves. In the recycling value chain, we identify two types of “buyers”—customers that buy recycling services, and end-market buyers of recyclables. Each has a unique motivation for seeking value, and each can deploy a set of negotiating strengths that we believe can limit pricing power.

On the service side, recycling has an attractive value proposition when disposal costs are high and commodity revenue can offset the total cost of a municipal or corporate garbage bill. However, this relationship begins with cost-saving in mind, presenting an immediate challenge for the development of pricing power. For example, many municipalities seeking to offset budgetary pressures with revenue from recycling programs understand market volatility and insist on guaranteed minimums from commodity sales as a condition for accepting lengthy contract terms.

End-market commodity buyers can establish a ceiling on the value of recyclables, suggesting a high degree of negotiating power. There wouldn’t be a recycling industry if processed recyclables were too expensive for manufacturers to use as inputs. Currently, the largest buyers of recycled materials are paper mills, because paper and paperboard products are relatively inexpensive to break down and repurpose into new products. For example, U.S. paperboard mills will supplement manufacturing with recycled materials when the cost differential between sourcing and processing old corrugated cardboard (OCC) and virgin pulp makes economic sense.

In aggregate, the influence of Chinese paper mills on the flow of materials often leads to price disruptions. For example, 2013 recovered paper prices remained depressed because of more stringent quality control procedures at Chinese ports. Operation Green Fence enforced an additional restriction of residual material commingled with recyclables by rejecting shipments outright or by forcing sellers to accept lower prices for materials that had been acceptable in the past. In our opinion, when a concentrated group of buyers has this much influence on the market, it is difficult for recyclers to exert any level of pricing power.

Supplier Power

A difficult conundrum exists when the customers of a vertically integrated disposal contract become the de facto suppliers of recyclables. Once again, this dynamic describes the fundamental difference between operating a disposal business and operating a recycling business: To deliver inventory to a commodity buyer, recycling operators must purchase commodities from their customer-suppliers. In Porter’s framework, powerful suppliers can charge higher prices or demand more favorable terms when their involvement is necessary at each node of the value chain. When recycling is part of a vertically integrated disposal system, this creates an opportunity for the supplier-customer to demand a whole host of concessions. Unfortunately, this can destroy value created by the disposal segment of the chain.

Threat of Substitutes

The most obvious substitute for recycling is landfill-based disposal, which remains the dominant form of waste handling in the United States. However, hybrid contracts pit these services against one another, causing one activity to create value at the expense of the other. In markets where the cost of land-based disposal is high, recycling can offer the customer cost savings up to a certain point. However, where landfill costs are low, customers won’t demand recycling if the service is too expensive. In these cases, recycling operators lose value by offering higher customer rebates to jumpstart recycling demand. Because recycling operations are more resource-intensive, the customer must be willing to pay a higher price for the provision of recycling services for the vendor to realize attractive returns on invested capital. However, there isn’t any economic incentive for the customer to do so when landfill disposal is markedly cheaper, even with commodity revenue factored in.

Corporate mandates or municipal regulations that support recycling can represent a favorable situation by limiting or eliminating the threat of substitution; however, we argue that price competition to win contracts in these markets can be fierce. This special class of customer often sets lofty diversion goals motivated by environmental philosophy or political gain, which are often difficult to meet without expensive investments in large single-stream MRFs. Furthermore, processing a wider range of disparate materials often leads to greater operating costs per ton. In this case, profits from commodity sales are often used to subsidize the higher cost of meeting such ambitious diversion goals, limiting the overall return for the recycling operator.

Threat of New Entrants

Adding recycling services to a vertically integrated system can protect incumbents against new entrants by exerting control over the entire local waste stream. At a certain collection distance it becomes too expensive to process incremental tons at a MRF because of higher transportation costs. As such, stand-alone MRFs that are forced to attract recyclables from established collection contracts by offering higher rebates can easily destroy value, especially when commodity resale values are low. Vertically integrated systems can exhibit stronger barriers to entry than a stand-alone recycling operation; however, this doesn’t always translate into superior returns, especially when incumbents offer steep discounts to preserve customer retention.

Rivalry Intensity

In competitive markets, we believe firms offer recycling in an attempt to offer customers a differentiated value proposition. Landfills and their associated post-closure obligations create high barriers to exit, and several national players share a rational oligopoly in most urban disposal markets. These characteristics can occasionally lead to some intense battles for disposal volumes, especially during down-market economic cycles when trash generation is depressed and excess capacity exists in certain markets.

In the simple disposal value chain, there isn’t much a landfill owner can do to differentiate service, outside of offering a more favorable location to cut down on transportation costs. As such, when there is excess disposal capacity in these markets, recycling presents another way to compete for business. A vertically integrated contract that includes recycling has the potential to derive outsize value when commodity prices are high; however, we surmise that using recycling as a means of differentiating a disposal contract runs the risk of dissipating any excess value through a higher cost of competing.

As demand for recycling grows, a waste company must demonstrate economic profits throughout a commodity cycle before it can claim recycling as a true moat-building competitive advantage. This requires the ability to derive higher prices, lower costs or both relative to peers throughout a vertically-integrated disposal/recycling system. While the structural characteristics of the recycling industry makes this difficult to sustainably achieve, understanding the five sources of competitive advantages as defined by Morningstar’s economic moat framework can help managers make strategic choices that protect long-term profitability generation.

Barbara Noverini is an Equity Analyst for Morningstar, Inc. (HQs), covering business services firms, waste management providers, and other companies in the industrials sector. Prior to joining Morningstar in 2011, she was a research analyst for DeMatteo Monness LLC, a boutique broker/dealer, for five years. From 2001-2006, she was a researcher in litigation services for Round Table Group, Inc., which is now a part of Thomson Reuters. She began her career as a quality assurance analyst at Hewitt Associates. For more information,

Figure 1

There are five different economic moat sources.

Figure courtesy of Morningstar, Inc.