Business owners should consult with their CFOs and tax advisors to understand the best financial options and the best ways to approach them.

Ryan Edwards

The refuse industry appears to be embracing natural gas vehicles (NGVs). As we’ve seen in recent years, the conversion from diesel to natural gas continues to be robust, with some haulers making the switch voluntarily and others doing it in order to be eligible to follow through on contracts they’re awarded—contracts that may call for reductions in air and noise pollution in the communities being served. According to an article in Heavy Duty Trucking magazine, “Refuse fleets are one of the fastest growing markets for compressed natural gas, primarily because of the significant fuel cost savings that can be realized.”

The refuse industry appears to be embracing natural gas vehicles (NGVs). As we’ve seen in recent years, the conversion from diesel to natural gas continues to be robust, with some haulers making the switch voluntarily and others doing it in order to be eligible to follow through on contracts they’re awarded—contracts that may call for reductions in air and noise pollution in the communities being served. According to an article in Heavy Duty Trucking magazine, “Refuse fleets are one of the fastest growing markets for compressed natural gas, primarily because of the significant fuel cost savings that can be realized.”

Although the price of compressed natural gas (CNG) per diesel gallon equivalent (DGE) varies compared to the cost of diesel, natural gas is widely seen as offering a cost advantage. NGVAmerica, an organization which represents 230 companies, environmental groups and government organizations that promote natural gas and bio-methane as transportation fuels, notes that just over 18,000 NGVs of all types were sold in 2014. The heavy-duty segment of the market was up 30 percent over 2013, while the medium-duty segment was up 24 percent.

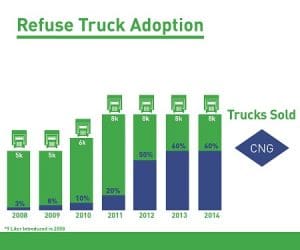

In 2008, when the 9L Cummins Westport natural gas engine was introduced, 3 percent of new refuse trucks purchased in the U.S. were fueled by natural gas, according to one estimate. By last year, that percentage had increased dramatically. Moreover, 60 percent of the roughly 8,000 new refuse trucks purchased run on natural gas.

The city of Los Angeles, which is implementing massive changes to its trash collection system, is a microcosm of what’s happening in the industry nationwide. Today, owners of multi-family and commercial properties in L.A. choose companies to handle their garbage pickup. Beginning in early 2017, the city will be divided into 11 regions, with one hauler per zone. Haulers are already responding to the city’s request for proposals as they compete for the 10-year contracts.

The city’s new system is “aimed at reducing landfill waste and pollution,” according to the Los Angeles Times, and NGVs play a key role. “To be eligible to win each zone, haulers would have to provide separate bins for recycling and use ‘clean fuel’ vehicles, among other ecologically friendly requirements.”

For haulers in L.A. and beyond, there’s a lot to consider before making the leap from diesel to natural gas. This article offers five factors businesses can consider when determining whether to add NGVs to their fleets.

#1: Do the Math

Refuse trucks powered by natural gas have an average incremental cost per of $38,200 compared to diesel-powered refuse trucks, according to a U.S. Department of Energy case study on CNG deployment by two waste management businesses and one municipality. It found that “the fuel cost savings available to these fleets produced quick payback of the upfront capital costs for CNG vehicles (incremental vehicle costs, fueling station costs and vehicle maintenance facility upgrades).”

The actual savings will depend on a variety of factors, including annual miles traveled, miles per gallon and fuel type. (In the refuse space, CNG is the more commonly-used fuel; liquefied natural gas, or LNG, is generally used for over-the-road trucks.) To find general estimates of the cost of switching from diesel to natural gas, business leaders can get started by looking at a fuel cost comparison calculator, such as the one accessible at www.gecapitaltransportationfinance.com/how-we-can-help/alternative-fuels. It is provided by ACT Research exclusively through GE Capital, Transportation Finance. Fuel providers and fueling system sellers are often able to provide more in-depth estimates that take into account the wide range of factors that can be considered.

#2: Determine What Type of Equipment is Needed

Do you need trucks alone or do you need other equipment as well? If your business has reached the tipping point where it makes financial sense to build your own CNG fueling station, that will significantly increase your upfront investment beyond the cost of trucks alone. The Alternative Fuels Data Center, part of the U.S. Department of Energy, says that a station capable of dispensing 1,500 to 2,000 DGE per day costs $1.2 million to $1.8 million. If the hauler decides to build its own CNG fueling station, the incremental cost will be $1.2 to $1.8 million.

Companies that choose to build their own stations should figure in construction and equipment costs as well as expenses related to permits and engineering studies. Moreover, expert advice along the way will be crucial to ensure you make the most of your capital expenditures.

#3: Factor in Ancillary Costs Including Refueling, Training and Maintenance

“Effective CNG station maintenance can determine the success or failure of both a CNG station and the overall NGV program. Yet maintenance is perhaps the most often overlooked issue affecting most CNG fueling stations,” wrote Leo Thomason, executive director of the Natural Gas Vehicle Institute (NGVi), in a report titled “CNG Fueling Station Maintenance Overview & Commonly Overlooked Items.”

Considering this, haulers will need to provide maintenance technicians and drivers with training on safe vehicle repair, operation and fueling practices. NGVi provides programs to ensure safe driving, fueling and maintenance as well as standardized fuel system inspections. Engine maker Cummins provides a variety of training options to help service technicians understand how to work on natural gas engines.

Just like maintaining a truck with a CNG engine, maintaining a natural gas fueling facility requires specialized knowledge. Haulers can learn to maintain their own fueling systems or hire a third party—typically a company affiliated with the facility’s builder—to do it for them. As with any service, haulers should talk to potential service providers to understand the pros and cons of outsourcing that maintenance.

#4: Research Potential Lenders to Fully Understand Available Financing Options

Financing NGVs doesn’t have to be a challenge. Municipalities have unique financing needs that can be managed in a variety of ways, depending on local regulations. Tapping the capital markets may be the preferred option for large, publicly-traded haulers. Mid-sized haulers and privately-held companies have options as well. They can use cash on hand or reach out to lenders such as local banks and finance companies that specialize in refuse vehicles.

An industry-savvy lender should have a good understanding of a reasonable business plan as well as the competitive dynamics at play in the refuse industry. That knowledge should be helpful in arranging financing and maximizing the credit available to each individual hauler.

#5: Decide Whether to Purchase or Lease Equipment

When it comes to acquiring new trucks, some companies pay cash, some finance them with loans and others choose to lease. Before bidding on a new contract, inventory your fleet. Decide how many trucks need to be replaced and how many need to be added to accommodate new business. If you need to increase the number of trucks on the road and add NGVs to the mix, you may be looking at a larger-than-normal cash outlay.

If paying cash for new equipment will be difficult, it’s time to talk to your lender about upcoming financing needs, particularly if you think you’ll be awarded a contract that requires a substantial investment in new equipment. If your lender of choice can’t meet your needs, you should develop a plan that allows plenty of time to find others that can help.

For those who decide to lease, it’s important to understand the differences between various types of leases available in the U.S. A terminal rental adjustment clause (TRAC) lease typically passes on the tax benefits to the lessor, but it may be structured to include services to support a fleet while the lessee retains some residual risk.

A fair market value (FMV) lease typically has lower monthly payments than a comparable loan; at the end of the lease term, the borrower can buy the equipment for its value at the time, or return it to the financial institution that provided the lease and walk away hassle-free. In this case, your lender takes on the risk of disposing of the equipment.

There’s one more important point to consider: hauling contracts often range from five to 10 years, depending on the municipality. When equipment payments can be spread out over 120 months instead of 60 months, haulers’ purchasing power has effectively increased.

Understand Your Options

In all cases, business owners should consult with their CFOs and tax advisors to understand the best options for them and the best ways to approach all financial commitments.

Ryan Edwards is a senior sales leader for GE Capital, Transportation Finance (Irving, TX), the nation’s largest independent finance company serving the over-the-road trucking industry. Ryan is responsible for sales in the natural gas and refuse businesses, overseeing a team of dedicated sales representatives that covers all of the U.S. Transportation Finance serves all aspects of the U.S. trucking industry including manufacturers and dealers as well as truck fleets and owner-operators. It offers wholesale and retail financing as well as equipment leasing. He can be reached at (469) 586-2432 or via e-mail at [email protected]. For more information, go to www.gecapital.com/transportation. To stay up-to-date on news in the commercial lending and leasing world, follow http://twitter.com/GELendLease.