Waste-By-Rail

Fuel in the Rail Industry

As more waste commodities require longer haul distances for disposal, reprocessing or recycling the continued rail fuel gains will translate into more economical transport options that are also environmentally friendly.

Darell Luther

“One ton of freight, nearly 500 miles on one gallon of fuel,” as advertised on television by a major Class I Railroad catches one’s attention. Fuel is an important component of any bulk transporters cost and in an industry that moves billions of tons of freight annually, it’s even more important. In 2011, freight railroads consisting of nine (U.S., Canada and Mexico) Class I railroads and approximately 500 plus regional and shortline railroads generated more than $50 billion in freight revenues.

Railroads are classified based on their operating revenues; freight railroads are categorized into three segments: Class I with annual operating revenues above $346 million, Class II with revenues in the range of approximately $27.8 million to $346 million and Class III (generally called shortlines) for those that fall under the $27.8 million range.

The fuel use of these combined railroads is an astronomical number. Class I railroads reported locomotive fuel consumption in 2009 for transporting freight (excludes transporting maintenance of way and passenger cars) of 3.192 billion gallons. This equates to an average of hauling one ton of freight 480 miles on one gallon of fuel. That’s up from 436 ton-miles in 2007 and 457 ton-miles in 2008. The advertised rate on television of “nearly 500 miles on one gallon of fuel” reflects more fuel-efficient and hybrid locomotive replacements and unit train efficiencies driving even more efficiency out of each ton mile of freight.

As more waste commodities require longer haul distances for disposal, reprocessing or recycling the continued rail fuel gains will translate into more economical transport options that are also environmentally friendly.

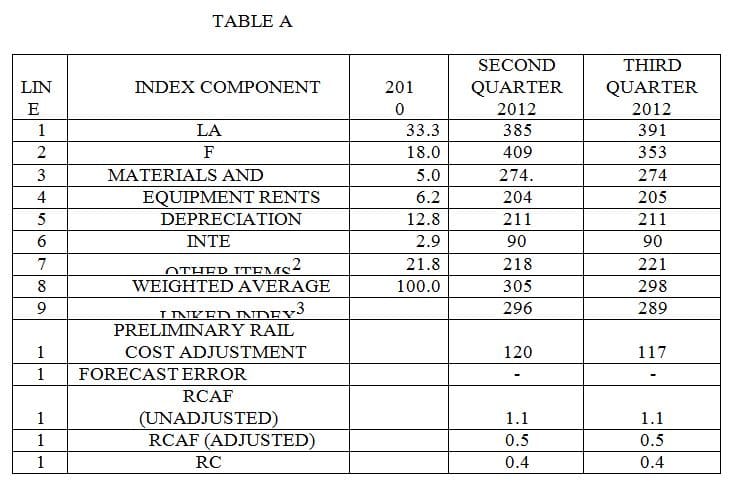

Fuel Index

Fuel is extremely important in the railroad industry as a major cost component. Fuel represents the second highest line item cost to railroads at 18 percent of overall railroad input costs. Labor is the highest single line item cost at 33.3 percent of overall railroad input costs. Labor and fuel are the two major inputs to an index of railroad expenses called the Railroad Cost Recovery Factor developed by the Association of American Railroads (AAR) and approved by the Surface Transportation Board (STB), a first generation regulation governance body put in place after the demise of the Interstate Commerce Commission in 1995. The STB is responsible for calculating the index of railroad input prices and the method of computing the rail cost adjustment factors in Railroad Cost Recover Procedures (see Table A).

The Railroad Cost Recovery Factor is a forecast index of U.S. railroad expenses that is developed by the Association of American Railroads (AAR) and approved by the Board. It is published quarterly. The Board’s predecessor, the Interstate Commerce Commission (ICC), outlined the procedures for calculating the all-inclusive index of railroad input prices and the method for computing the rail cost adjustment factor in Railroad Cost Recovery Procedures, 1 I.CC.2d 207 served in 1984. 49 U.S.C. 10708 directed the board to publish both an unadjusted RCAF and Productivity-adjusted RCAF. The Board also decided to publish a second productivity-adjusted RCAF called the RCAF-5. Consequently, three indices are now filed with the Board by the AAR, the RCAF (Unadjusted), the RCAF (Adjusted) and the RCAF-5. The RCAF (Adjusted) reflects national average productivity changes as originally developed and applied by the ICC and is currently based on a five-year moving average measure of productivity. The RCAF-5 reflects national average productivity changes as if a five-year moving average measure of productivity had been applied consistently from the productivity adjustment’s inception in 1989. For complete details and end notes, visit www.aar.org/~/media/aar/RailCostIndexes/STB-RCAF-2012-Q3-decision.ashx.

Fuel Application to Freight Rates

The passage of the Staggers Rail Act of 1980 removed many of the regulatory restraints on the railroad industry. This provided railroads the flexibility to adjust their rates and tailor service to meet shipper needs and their own revenue requirements. Not only did railroads have the flexibility to disengage from costly assets that weren’t generating returns such as under-used branch lines, but they also had the ability to apply selective pricing.

It wasn’t until the early 2000s that Class I railroads faced with rapidly expanding fuel costs segregated the cost of fuel from other cost components and implemented a fuel surcharge. At first these fuel surcharges were generally charged as a percentage of the freight tariff or contractual agreement. Over time, they grew to take on many forms and by the early 2000s, most all Class II and Class III railroads had also implemented fuel surcharges.

A regulatory proceeding engaged the STB on January 25, 2007 to standardize fuel surcharges across railroads and ruled that, among other things, computing rail fuel surcharges as a percentage of a base rate is unreasonable business practice because rail rates do not accurately reflect the additional cost of fuel used in individual movements. Railroads (in the U.S.) had until April 26, 2007 to comply with the STB ruling. While standardization of the fuel surcharge process pleased many shippers that moved commodities across various railroads, the continuous increases in fuel surcharges did not.

Current Fuel Surcharge Methodology

The standardization by the STB of fuel surcharge methodology went on to require that railroads use the U.S. Average Retail On-Highway Diesel Fuel (HDF) as reported by the U.S. Department of Energy Web site as an index in calculating fuel surcharges. These HDF prices are then used as the basis for fuel surcharge billing. Currently, the HDF is used to index fuel price changes and are applied to shipments either through a mileage-based program or a percentage-of-revenue-based program.

Recent Rail Fuel Legal Issues

Despite the standardization of methodology by the STB many shippers still believed that railroads where using fuel surcharges to unilaterally increase freight rates with no bearing on actual railroad fuel costs. Shippers representing large American corporations in the chemicals, agriculture, automotive and public utility industries filed original lawsuits in 2007 combining a total of 18 similar lawsuits. Earlier this year those suits were combined into a Multi District Litigation (MDL) against the four largest U.S. railroads comprised of the BNSF Railway, Union Pacific Railroad, Norfolk Southern Railway and CSX Transportation.

This MDL is certified as essentially a class action lawsuit and includes all direct purchasers of rate unregulated rail freight transportation services and applies to fuel surcharges that were applied from mid-2003 to 2008.

It Bears Watching

Although the waste industry uses rail to an extent, it is generally a small percentage of the transport options used by this industry; however, class action suits tend to run the gambit of the industrial sector to which they are applied. There’s somewhat of a tsunami effect going on here, does an industry that is heavily fuel dependent, as is the waste industry, stand by and watch hoping to reap the rewards of adjusted fuel surcharge indexes – or – participate hoping the tsunami wave isn’t directed to the truck side (waste collection, etc.) of the industry thus having a direct effect on those companies that also use fuel surcharges as part of their pricing methods?

In either case one can expect at the end of the day that rates will be adjusted to compensate for any fuel surcharge revenue generation differentials a win or loss will cause.

Darell Luther is president of Forsyth, MT-based Tealinc Ltd., a rail transportation solutions and railcar leasing company. Darell’s career includes positions as president of DTE Rail and DTE Transportation Services Inc., Fieldston Transportation Services LLC, managing director of coal and unit trains for Southern Pacific Railroad and directors positions in marketing, fleet management and integrated network management at Burlington Northern Railroad. Darell has more than 24 years of rail, truck, barge and vessel transportation experience concentrated in bulk commodity and containerized shipments. He can be reached at (406) 347-5237, via e-mail at [email protected] or visit www.tealinc.com.

Table A

EP 290 (Sub-No. 5) (2012-3). All Inclusive Index of Railroad Input Costs.

Table courtesy of AAR.