Your “pit crew of partnerships” can help your company drive away with an auto shredder as well as winning with environmental and economic success.

By ElizaBeth De Maagd

Did you ever love to explore junkyards as a kid? As a child, my father would take my brother and I to junkyards to investigate mounds and mounds of pure junk. Our favorite memories were watching cars being crushed into smithereens. One particular fond memory was watching a huge crane with a shiny ball magnet pick up an avocado green station wagon. As the crane lifted the rusty, retired vehicle, my brother and I jumped up and down and yelled, “Crush it! Crush it!” The old station wagon was dropped into a huge monster crusher device. We thought it was so neat to hear and see the car being crushed to form a huge metal cube. We could have stayed there for hours watching automobiles find their demise to the car eating monster machine. Thank goodness that automobile manufacturers have retired that god awful avocado green color … the only green I want to see now is “going green” for the environment and shear economic benefits for recycling automobiles.

Some decades later, recycling technology has taken the practice of crushing automobiles to unbelievable new heights by providing safe practices of going green through the usage of auto shredders. The auto shredder is going green in several ways by making greenbacks from the materials separation process, to improving green environmental standards through carefully shredding and recycling materials such as plastic, aluminum and copper. Since some auto shredders can run in the millions to buy and install, banking and financial institutions are working closely with scrapyard owners to understand the economic impact of adding this equipment to their operations. With this necessary financing from these institutions, owners can now provide this green service; the finish line is a win-win for all involved.

The Auto Shredder Process

First, let me drive you through the process of an auto shredder to fully understand the capabilities of this extraordinary machine. A vehicle has a so-called “second life” when it is taken to a shredder facility so all of its components can be recycled to extend its lifecycle. Automobiles that enter the salvage yard are inspected for parts that are still functioning and then these parts are removed, batteries and catalytic converters are detached and resold.

The remaining body and parts are further prepared and fed to a hammermill type machine called an auto shredder. An auto shredder horsepower can vary from 1,000 to 10,000 mega horsepower machines. This machine acts like a tree chipper and grinds the parts into tiny pieces. The ferrous and non-ferrous metals are transported to other locations to be recycled and any ASR (automobile shredder residue) is directed to a landfill or for other disposal. This type of residue many times is used as a beneficial product such as landfill daily cover material. Categorized materials under ASR, which are recyclable, include plastic, rubber, glass, liquids, and fiber and it is estimated that 50 percent of these ASR materials can be recycled and even transferred to alternative fuels with the remaining material sent to landfills.

Financial Portfolio

The organic and inorganic materials from ASR has many different uses such as a retarder for cement, ASR plastics to synthesize crude oil, and plastic residue which can be used for industries that include construction and agriculture. An interesting article on this subject entitled “Breakthrough Moment” by author Brian Taylor1 shares advancements with ASR that operators should consider. One of the advancements that caught my eye was the discussion of taking ASR and converting it into synthesized crude oil, natural gas and a carbon product.

More than “breaking even” is on the minds of financial institutions when lending a company money. Increasing the salvage company’s profits is essential for financial institutions to provide funding for auto shredders. When shredders can be purchased at a cost measured at $10+ million dollars, foundering institutions want to see the value of this machine to justify a loan to prospective clients. Some involved purchasers have done their homework and understand that when you are in the driver’s seat with a bank you want to show that you are a true salvage car contender in this industry, so you can drive away with your auto shredder machine.

The type of financial portfolio needed for banks in order to lend for purchasing an auto shredder is called a “business valuation.” There are many reasons why financial institutions would need a business valuation to determine if a company has the present cash flow adequate vehicle backlog, and future cash flow for the new expensive equipment that they are financing. Business owners should always know how much their business is worth, or know the accurate market value of a business. The procedure for determining the true value of a business including all of its assets can be complex.

Business Valuations

One might ask what is involved in a business valuation. A reliable business valuation includes a comprehensive analysis of the entire business, including all of its assets, as well as the future value of its current and planned operations and a complete market analysis of trends, competition and regional geographical mapping of transportation routes, and designated end users of the products generated. A businesses valuation may also be needed even when the business does not need financing for equipment; it could be used for a potential sale or to support estate planning for an owner or partner, for succession planning, to secure a line of credit or to facilitate a number of other key events that occur in the lifecycle of a business. In all of these cases, a well-documented, objective, and accurate business appraisal or capital assets valuation can be of critical importance.

Experienced waste business valuation experts who can accurately provide this type of service in the waste management industry niche is very limited. The types of deliverables and experience that you look for when searching for a company includes these type of questions; how many years have they been in the waste management consulting business, do they have specialists in the areas of waste management where you operate, do they have contacts and can they complete an accurate financial services and marketing analysis, what is their reputation and do they provide a quick follow through with the project, and can they help secure financing through their network of lenders and financial institutions?

Experienced waste business valuation experts who can accurately provide this type of service in the waste management industry niche is very limited. The types of deliverables and experience that you look for when searching for a company includes these type of questions; how many years have they been in the waste management consulting business, do they have specialists in the areas of waste management where you operate, do they have contacts and can they complete an accurate financial services and marketing analysis, what is their reputation and do they provide a quick follow through with the project, and can they help secure financing through their network of lenders and financial institutions?

After the business valuation is completed, the next step for the waste industry client is submission of this market analysis and financial business portfolio to justify a “so called multi-million dollar financial commitment.” Even though scrap metal is in high demand, companies who want to buy an auto shredder can’t just walk into a bank and walk out with the funds required. What can you expect after a valuation and loan submission? Typically, the package will include historical and “what if” presentation scenarios that will show the changes that will take place with the business and the company’s finances. The valuation experts will need to support and help manage the process through the submission, evaluation, Q&A and even assist with the documentation of the loan arrangement to help support the business through the process.

A Circle of Partnerships

The finish line for auto shredders includes a circle of business partnerships. The partnerships include the auto shredder equipment company, the business valuation company, the financial lending institution as well as the company’s legal representative to view all business documents. A refreshment on the steps to follow: first, fully investigate the best auto shredder for your business. Secondly, analyze the competition and then find the correct funding source. Next, develop a complete project proforma and financial forecast along with the actual business valuation are all important parts of this process. Your “so called pit crew of partnerships” can help your company drive away with an auto shredder as well as winning with environmental and economic success.

ElizaBeth De Maagd is a Publication Writer for the waste industry as a Partner at Sterner Consulting (Pittsburgh, PA), a Waste Management Consulting and Merger and Acquisitions Firm. She also writes their newsletter Trash Happens. She can be reached at (412) 944-0212 or via email at [email protected].

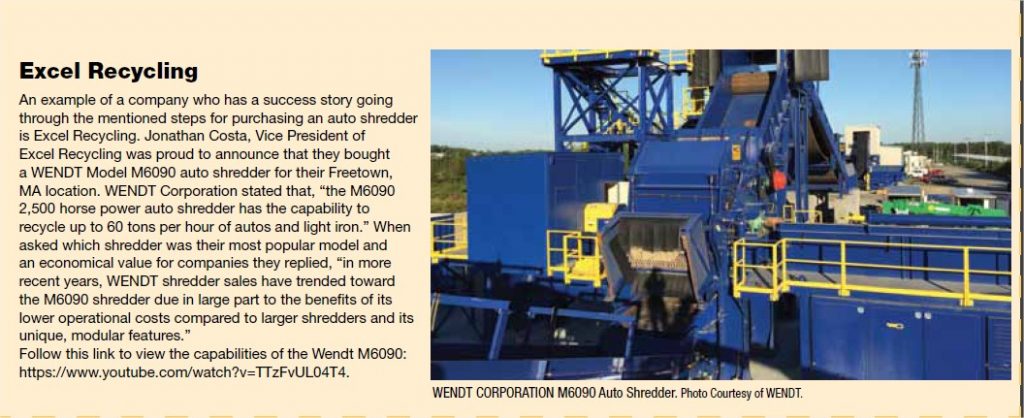

Note

www.recyclingtoday.com/article/rtge0512-auto-shredder-residue-debate/