How merger and acquisition valuations are determined in the waste and recycling industry.

Bradford Page

One of the most common questions that an investment banker receives from business owners is: “How much is my company worth?” As is frequently the case, the right answer is, “It depends.” Valuation is a function of both quantitative and qualitative measures and requires considerable judgment and experience.

This article will address fundamentals and market dynamics that go into determining valuation and identify factors that buyers consider when valuing an acquisition target. It should be acknowledged that the specifics of every business are different and warrant a detailed analysis that is beyond the scope of this article.

Valuation Fundamentals

Valuation is typically determined using three types of analyses: discounted cash flow analysis, comparable company analysis and comparable transaction analysis. The first methodology is based on the projected stream of future cash flows; the second two are market-based. It is important to note that a comprehensive valuation will likely incorporate all three plus additional methodologies that are beyond what will be addressed in this article.

The intrinsic value of a business is most frequently determined via a discounted cash flow (DCF) analysis. A DCF analyzes a company’s anticipated future cash flows and applies an appropriate discount rate to account for the variability (or riskiness) of those cash flows. A higher discount rate implies increased riskiness and translates to a lower implied value. The usefulness of this approach, however, is limited by the accuracy of the many assumptions that are built into the calculation. (When bankers and accountants use the phrase “garbage in, garbage out,” they aren’t talking about waste collection.)

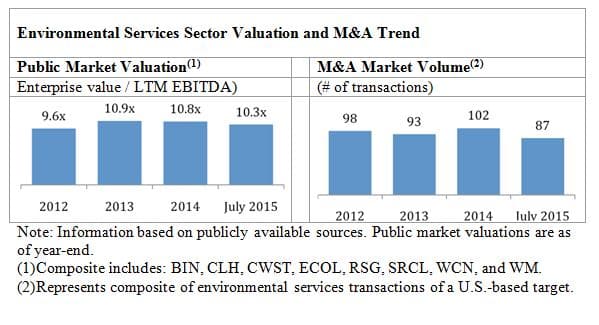

A comparable company analysis assumes a basket of publicly traded companies that are comparable to the business receiving the valuation. A comparable company can be determined based on factors such as similarity of the business model, size, margins, growth and geography, among other factors. A market-based multiple is found by analyzing the relevant enterprise value divided by the last 12 months’ revenue or EBITDA (earnings before interest, taxes, depreciation and amortization). The analysis should include at least three comparable companies to provide a meaningful sample size, and once the number increases above 10, the impact from any additional company is muted.

A comparable transaction analysis is based on valuation information from comparable businesses that have been acquired. This analysis effectively answers the question of “How much have buyers paid for businesses similar to mine?” Each transaction has a valuation and a corresponding implied valuation multiple that generally is based on historical revenue and EBITDA. Comparable transactions provide great insight into value, but the relevant information can be difficult to determine and is frequently not disclosed, particularly for smaller companies.

A range of valuation multiples is determined from the analyses of comparable companies and comparable transactions, and that range is then applied to the relevant financial metric of the company that is receiving the valuation. The most common financial metrics are a company’s last 12 months of revenue and EBITDA, which when multiplied by the range of valuation multiples, results in a range of implied values for the business.

EBITDA is typically thought of as the best valuation starting point because, by stripping out capital structure decisions and taxes, it is the metric that most closely resembles cash flow without an overly complex definition. Revenue multiples are also reviewed but are less important because of the potential for variability of profit margins (see Table 1).

In the waste industry, valuation tends to center on eight to 11 times EBITDA. This is a wide range, and where the multiple falls along this range will have an enormous impact on the value ascribed to the business. While the three approaches discussed above provide a great starting point for determining value, no two companies are alike. When determining whether a company merits a higher or lower valuation, details such as growth rates and profit trends, revenue, EBITDA and cash flow will all be important.

In addition to these numbers, there are various important value drivers that help determine (and in many cases improve) value.

Value Drivers

Beyond the financial metrics, there are other nuanced factors that determine the value that a company receives relative to its peers. In investment banking parlance, these factors are referred to as “value drivers.” How a company rates across these value drivers can significantly affect the value of a company. Here is a quick look at several value drivers in today’s waste and recycling M&A (Mergers & Acquistions) market.

Timing and Momentum

The best time to consider selling a business is when trends for the company are positive. This momentum could take the form of an uptick in revenue growth or a recent catalyst for enhanced profitability, such as a new fleet of trucks, acquisition of new routes or renegotiated contracts with more favorable pricing terms. In addition to enhancing the company’s near-term financial performance, these growth and profitability catalysts can generate additional excitement and buyer interest.

The current M&A markets are very active, and valuations are good. Strategic buyers are looking for ways to improve their growth profile, and private equity is looking for attractive investment opportunities with positive sector trends. Value is typically improved in times of growth and market enthusiasm.

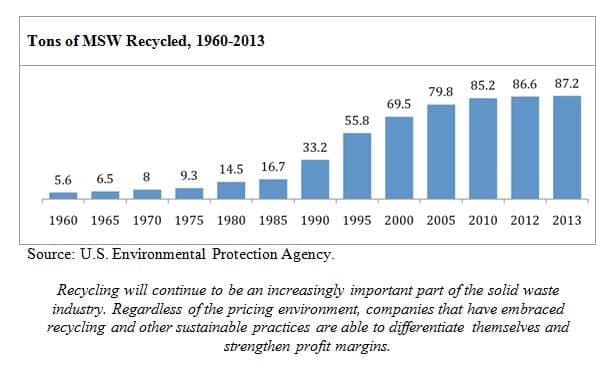

Focus on Sustainability

Whether mandated by legislation or driven by consumer demands, sustainability is a theme that is here to stay. In the waste industry, recycling and other environmentally friendly practices will be an increasingly important part of what drives buyer appetite. Commodity prices have continued to drift lower and have not cooperated with business performance, but long-term themes and trends in the industry remain compelling. Businesses that are able to differentiate with assets or business models that promote sustainability will see a valuation benefit (see Table 2).

Consistency of Financial Performance

From a buyer’s perspective, one of the most attractive qualities of the waste industry is the predictability and consistency of volumes and revenue. Buyers generally are willing to accept some degree of short-term variability in performance as long as the long-term trends are positive and relatively stable. Companies that have had consistent long-term performance will achieve a higher value.

Companies with long-term contracts, franchise regions, or entrenched and defensible market positions are likely to display the consistency that buyers value. Each can provide steady, predictable profits for the future owners.

Safety and Training

Solid waste management can be a dangerous business. Increasingly, those companies that are able to highlight improving safety records are achieving premium valuations. In addition to improving safety trends, buyers will want to see that the company has training and procedures in place to ensure that the trend is repeatable and institutionalized. This, in essence, proves the company’s commitment to safety and training.

Thinking Beyond Valuation

Valuing a company is not a straightforward, one-size-fits-all process. Valuation is a function of the company’s recent and projected financial performance, supply-and-demand market dynamics, and the company’s ability to deliver on important value drivers.

While valuation is obviously an enormously important piece of the puzzle, it is not the only determinant of a successful outcome for a seller. In addition to receiving an attractive valuation, other factors that often are important to sellers include the timing of when the deal closes, finding a buyer who is a good cultural fit, and the opportunity to participate in the continued growth of the company. In an upcoming article, we will examine some of the non-value-related factors that go into making a successful outcome for the owner of a waste and recycling business.

Bradford Page is a member of William Blair’s investment banking team and is the head of its environmental and industrial services practice. William Blair works closely with public companies, private companies, business owners, and private equity investors on transactions related to M&A, equity capital and debt capital. He can be reached at (312) 364-8969 or via e-mail [email protected].

Fast Facts

Know the “Comps”: Examining valuation multiples of recent transactions involving comparable companies provides a good starting point for thinking about what a company is worth.

What Drives Value: Value drivers, such as safety and training investments or environmental sustainability, can significantly affect the valuation a company receives relative to its peers.