A review of the rail industry, the commodities it transports and the impacts on waste and scrap transportation by rail.

Darell Luther

The railroad industry in the U.S., Canada and Mexico is comprised of an extensive network of track and infrastructure that runs from the Hudson Bay in the north to the Gulf of Mexico in the south and from the Pacific Ocean to the Atlantic Ocean.

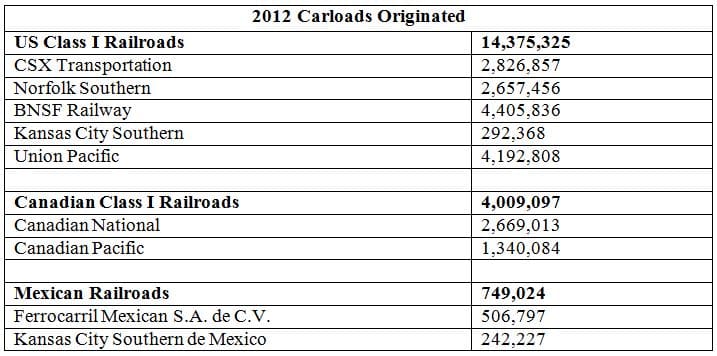

There are five Class I Railroads in the U.S., two in Canada and two in Mexico. A Class I railroad is defined as having annual operating revenue of $433.2 million or more. These railroads in 2012 transported a cumulative 14,375,325 carloads across 20 carload category groups (see Table 1).

An additional 6,718,522 originated carloads were generated in 2012 by a cumulative 423 U.S. and Canadian Short Line and Regional Railroads. Short Line Railroads are defined as having annual revenues of $34.7 million or less and Regional Railroads annual revenue ranges from $34.7 million to $433.2 million.

It is often stated that Regional and Short Line Railroads are the veins of the rail transport system gathering and distributing freight from and to customers while the Class I Railroads are the arteries transporting freight across longer distances (see Table 2).

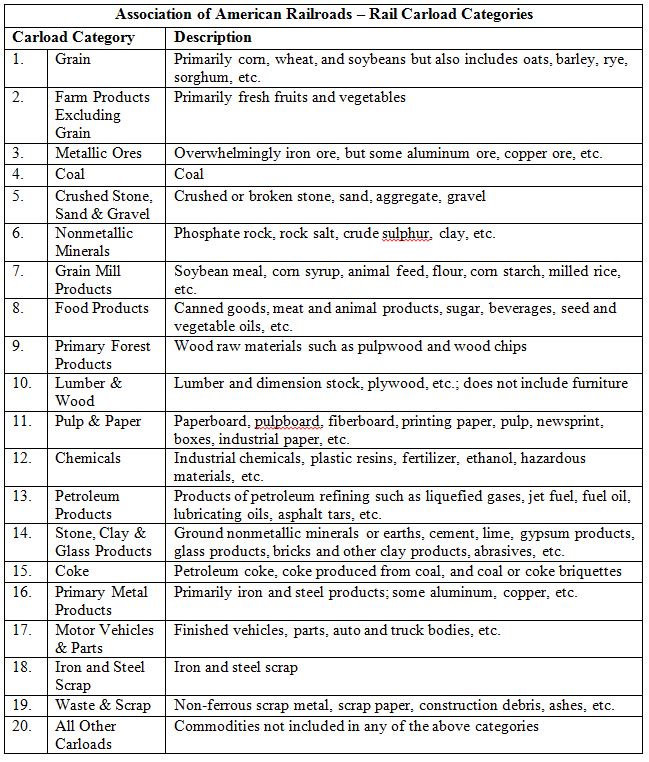

Rail carloads originated in the U.S. by commodity for these 20 groups reflect the health of each of these sectors. For instance some of the more heavily shipped products such as grain and coal, which according to the American Association of Railroads when combined together typically accounts for half of all U.S. rail carloadings, were down 9.5 percent and 10.8 percent respectively in 2012 when compared to 2011. Other groups such as aggregates (up 7.9 percent), lumber (up 13 percent), autos (up 16.5 percent) and petroleum (up 46.3 percent) indicate some boom and underlying strength to economic indicators that should translate downstream into stronger waste and scrap numbers.

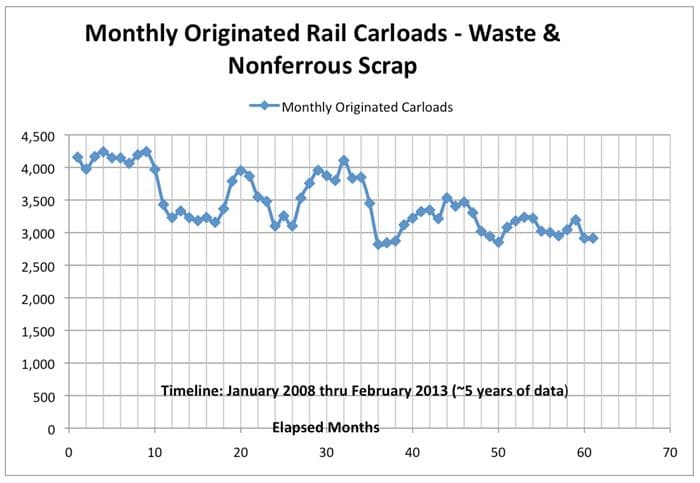

Waste and scrap numbers continue to post declines of 5.5 percent year over year from 2012 to 2011. The waste and scrap commodity grouping rail carload numbers are generally indicative of the overall long-term health of the economy. With fewer jobs, fewer owner-occupied houses and less general office leasing and building occurring the down-stream result is less waste generated. A reduced amount of waste generation can usually be absorbed by more local truck based landfills and doesn’t require longer rail hauls to support the volumes of waste and scrap being generated, hence the reduction in waste and scrap rail carloadings. A review of historical scrap data (see Table 3) indicates a steady 2008 and decline thereafter with small periods of recovery, but no solid strength as of yet in the overall economic stability of the U.S.

What Impact Does This Have on the Waste and Scrap Shipper?

There’s a number of phenomenon that are occurring in the rail industry that may reflect positively and even create an opportunity for entry for the waste-by-rail and scrap-by-rail shipper.

Increased Rail Velocity

Long slow and heavy coal and grain trains often take more human and locomotive resources. Pulling a train of 135 coal railcars across the country equates to around 19,000 trailing tons. You simply don’t go anywhere fast with that type of tonnage. The decreases in the coal business that can oftentimes take up to five heavy duty six axle locomotives equates to a few thousand surplus locomotives. In addition, the reduction in slower trains being replaced by faster trains also reduces the number of train crew that are required hence freeing up human resources to pull other trains.

Underused Capital Investments

The number one investment for a railroad is track. If a track isn’t being fully used due to the lack of heavy haul traffic (grain and coal) there is more of an incentive to offer competitive rail rates to other commodity shippers that can use that space. Particularly for long haul shippers such as the movement of municipal solid waste from municipalities to alternative landfills.

Availability of Idle Assets

In direct correlation with the locomotives that railroads have set in storage due to lower traffic volumes, shippers and railroads alike have parked railcars typically designed to handle these commodities in storage. A bleak forecast for market improvement within the near future may afford waste-by-rail shippers to lease and purchase rail equipment at lower market rates.

More Willingness to Work with Alternative Rail Shipments

Face it; waste-by-rail isn’t glamorous nor particularly repetitious when compared to large volume bulk commodities. It always seems to take a tweak to make it flow smoothly be it a requirement for odor control, covers, special packaging or baling, management of potential contamination or hazards, etc. There seems to be no rote in rail transportation of waste; however, with the significant increase in the petroleum business, railroads are putting more efforts into standardizing management of potentially hazardous or contaminating commodities that make the movement of waste by rail more acceptable to railroads.

Silver Lining

Despite the flatness of the overall economy, there are several silver linings for those that want to transport waste-by-rail. The impact and significant losses in major business lines for the rail carriers and their willingness to be more receptive to waste-by-rail both bode well for waste shippers. The data we’ve presented here coupled with the work we did for Idaho Waste Systems, Inc. (see Waste Advantage Magazine: January, February, March 2013) supports our optimistic outlook for the shipment of waste-by-rail.

Darell Luther is president of Forsyth, MT-based Tealinc Ltd., a rail transportation solutions and railcar leasing company. Darell’s career includes positions as president ofDTE Rail and DTE Transportation Services Inc., Fieldston Transportation Services LLC, managing director of coal and unit trains for Southern Pacific Railroad and directors positions in marketing, fleet management and integrated network management at Burlington Northern Railroad. Darell has more than 24 years of rail, truck, bargeand vessel transportation experience concentrated in bulk commodity and containerized shipments. He has received many exploratory calls inquiring how to ship various waste streams by rail and would welcome your inquiry as well.Darell can be reached at (406) 347-5237, via e-mail at [email protected] or visit www.tealinc.com.

*Tables courtesy of the Association of American Railroads.