In order for us to come out ahead on the other side of ongoing changes in the industry, the public sector needs to find smarter ways for procuring infrastructure, update or re-write solid waste management plans, encourage bold Federal and state policies to ignite technological advancements and engage their local populations.

Harvey W. Gershman

Solid waste management has evolved in the U.S. since it became a social focus, due in major part to the first Earth Day in 1970 as well as the Federal government’s desire to replace open dumps and uncontrolled incineration with more resource conservation and recovery approaches. In this article, I will look ahead in two ways: what I think may happen and what I think should happen. Also, along the way, there are several thoughts on how to better advance solid waste management within the framework of sustainability and zero waste. Depending upon whose number you believe, we have somewhere between 250 and 350 million tons per year of MSW to manage for our population.1 As I look forward, I believe there are several factors that will exert the most influence over the future of solid waste management.

Projected Changes to Landfilling Costs

The U.S. has made only modest strides in changing its waste generation and management practices as compared to many European Union countries. We have a system that only recycles about 30 percent of our waste. About 10 percent goes to waste-to-energy (WTE) facilities, and the remainder—more than 50 percent—goes to (thankfully) environmentally compliant sanitary landfills.

The primary antagonist for solid waste management sustainability in the U.S.—meaning, a system that does not rely on ever increasing consumption of raw materials and continued reliance on land resources for disposal—is the current availability of inexpensive landfill disposal. There are emerging factors, however, which will influence landfill costs in coming years. The first is air quality protections, which will press harder on methane recovery operations. As regulators look to protect and improve air quality, greenhouse gases will be targeted for controls. Methane is one of the most potent greenhouse gases emitted by human activity,2 and while its lifetime in the atmosphere is shorter than that of carbon dioxide, it is more efficient at trapping radiation.3 Though many landfills have methane recovery systems, overall, they still emit significant methane into the atmosphere as they operate. The second emerging factor is the increasing distance between current or future landfills and the population centers where waste is generated. Not only will economic costs increase, but also as disposal sites move further and further from population centers, the environmental impact of land disposal increases due to transportation emissions and fuel consumption, especially if using non-renewable fuels.

Law and Policy Changes

Recent changes in the Renewable Fuel Standards with the Pathways II Rule (July 2014) recognize biogas captured from landfills, wastewater treatment plants and agricultural digesters, as eligible for Cellulosic D3 RINs (renewable identification numbers). That means these can now be a commodity with a market value, making biogas more attractive for transportation fuel use. In California, there are also Low Carbon Fuel Standard (LCFS) credits for avoiding emission of carbon dioxide by using such fuel. According to the Coalition for Renewable Natural Gas and the American Biogas Council, biogas can be monetized even beyond its value to replace natural gas. The renewable identification numbers (RINs) and LCFS credits (in California) can add approximately $7 to $9 per MM BTUs to the value of the biogas, bringing its value up to $10 to $12 per MM BTUs. This gives biogas projects more of an opportunity to be economically viable, especially in California.

Unfortunately, no other states have any LCFS credits, and it is unclear for how long will these incentives be in place. Such uncertainly makes it difficult for owners and operators to count on them in the 10- or 20-year financial projections they make when determining the economic viability of new infrastructure. This is why we critically need an update to RCRA (spell out) for stronger national policy to encourage and empower industry to use the resources in our waste stream for improved environmental performance of our waste management system, and to create more sustainability jobs in America in the process.

Waste Stream Changes

The U.S. waste stream has changed significantly in the past 40 years and will continue to do so. For example, container packaging has changed from the tin, steel and glass containers in the 1970s to aluminum, plastic, and flexible multi-layer containers and pouches in the 21st century. The big daily (or twice-daily) newspapers have been replaced by much thinner publications perhaps printed or delivered only a few times a week, or maybe done away with entirely. Across all industries, packaging has been light-weighted. The reduction in glass containers, increase in more and lighter plastic containers, and exponential rise of multi-layer packages are having major impacts on the industry. This new waste stream is lighter, operating in an industry that buys and sells by the ton. At the same time, multi-material packaging is less recyclable!

Organics in the waste stream is not a new situation, but it is an emerging issue. In a recent online question-and-answer session, hosted by the Southeast Recycling Development Council, Assistant EPA Administrator Mathy Stanislaus reckoned that food waste in landfills accounts for 10 percent of manmade methane generation in the U.S. The Natural Resources Defense Council estimates that as much as 25 percent of such generation is the result of wasted food along the supply chain. At the same time, communities with mature recycling programs are “topping out” in the 45 to 60 percent range, and cannot mathematically advance their diversion without looking at organics. Thus, focusing more on food waste source reduction and use, as well as organics recovery, is becoming an important topic. The U.S. EPA has a new Food Recovery Challenge, and several states have banned the disposal of food waste entirely. To get at these organics, we need separate collections, significant mixed waste processing, or greater use of kitchen sink garbage disposers. There is a strong movement to bring anaerobic digestion (AD) from Europe here to the U.S. These AD systems are much more expensive than sending waste to landfills and will increase customers’ costs for solid waste services. Incentives for renewable biogas and biofuels certainly help; however, there is uncertainty with the longevity of these revenue sources, as I have already mentioned. There are a number of new project developers and technology purveyors in this space, and their performance and staying power is being proven as their new projects come out of the ground and are operating.

So, if we are taking more recyclables and the organics out, what is left? A residual material that has a significant heat value that can sustain combustion; it is often called refuse-derived fuel (RDF) or engineered fuel (EF). In the European Union, several countries are able to boast “almost zero waste to landfills” because they use the fuel fraction as a fuel for coal-fired electric utility boilers or other solid fuel boilers, cement manufacturing, dedicated boilers matched to industrial 24 by 7 steam demand, or, to fill up available mass burn waste to energy capacity created by more recycling and a diminished waste stream. Unless users are developed, some 40 percent or so of the U.S. waste stream will still need to be landfilled. If we can capture the heat value of these materials here in the U.S. as they do already in Europe, we would extend the life of our landfills and decrease methane emissions.

Cost of Solid Waste Collection

Approximately two-thirds of solid waste management costs are for collection, and the other third is for processing/disposal. If we want to see infrastructure added that will cost more—and, pretty much everything besides landfilling will cost more—without significant incentives from government, prices and rates will need to rise. The need for the ratepayer to bear these costs, in part, is due to the fact there are no nationwide taxes or prohibitions that create economic incentives for the rapid development of the necessary infrastructure to get our country less reliant on landfills and within the possibility of achieving zero waste. Regulations in the European Union and the UK impose taxes and penalties for landfilling greater than $100 per ton, incentivizing energy recovery and other alternatives. There are few such incentives in the U.S. to produce renewable fuels and power. Only a little over half of states categorize power derived from MSW as “renewable,” and the value of this power suffers further due to the abundance of domestic natural gas and growing supplies of power from solar and wind generation.

Besides general regulatory or economic incentives from the top level, the impact of price and rate increases can be ameliorated from the street level. For example, with a typical single-stream recycling program in place, twice-weekly collection of residential MSW is simply too much service. Changing it to once per week with carts or implementing a variable rate approach will drive costs down and send a signal that limitless trashing is no longer the norm. Industry and government procurers also need to stay focused on making collection more efficient and cost effective through the use of technology, including alternative fuels and in-cab computer systems. As single-stream recycling continues to spread, so can automated or semi-automated collection services using carts. Initiatives like the Curbside Value Partnership and the Closed Loop Fund are helping communities improve their curbside recycling programs with funding for better technology, services and public education programs.

A more systemic approach may be needed for the commercial sector. The City of San Jose, CA, decided to add processing and AD for commercial waste, and coupled that decision with closing the commercial collection market and setting up one contracted hauler for all services. The cost to the customer is increasing by approximately 20 percent, but that is not nearly as much as it might have done. The City of Los Angeles is also on a track to close the commercial collection services market in an effort to achieve higher diversion rates.

The Future of Processing and Collections

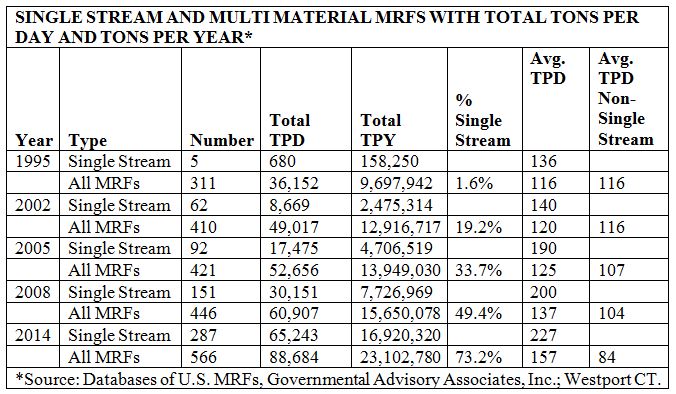

The growth of materials recovery facilities (MRFs) in the U.S. has been a wonderful thing for solid waste management. They are sorting and selling recyclable products that have value, and that value has been increasing over the past few decades recycling has taken hold. Now, the value of the sorted and sold basket of source separated recyclables can be in excess of $100 per ton in states without deposit legislation and upwards of $150 per ton in states with deposit laws that allow those deposits to be returned to MRFs for additional revenue. We now have a significant network of facilities that sort and market recyclable products to industry. Table 1 shows that we have processing capacity of more than 23 million tons per year and that the industry is changing from dual stream to single stream. Now with more than 70 percent of the clean MRFs being single stream, the large recycling cart should be the standard. Additionally, commercial generators can mimic the residential single-stream setout requirements using larger containers or several large rolling carts, rather than operating under a different set of expectations. While manual labor remains a significant element of any of these MRFs, sophisticated technologies in the single-stream MRFs now perform many of the sizing and sorting functions. Additionally, the data show that MRFs are generally getting larger in size; specifically, single-stream MRFs are getting larger while the remaining non-single stream MRFs are getting smaller.

To feed these MRFs, at last count, there were 9,000 curbside collection programs in place with source separation of waste and recoverable materials. Predominantly, two or more vehicles or “passes” go down the street to collect waste and recyclables, and in many of these locations, there may be another truck collecting yard waste, another for scrap metal and so on.

However, in some communities source separation is contracting. Pinched budgets and constant pressure to minimize tax and rate increases are usually the impetus, and managers look to reduce collection costs by eliminating one or more collections. Certain of these communities are turning to firms that can do the separation on the “back end.” There are 60 plants around the U.S. that were listed as “hybrid facilities,”4 sometimes called “dirty MRFs,” the more modern facilities—popular especially in California—use extensive processing and the most advanced technology to produce various streams for use by whatever end-users are available. These facilities are better described as “mixed waste processors” (MWP), and they intake both source-separated recyclables and process “trash” to diver from disposal as much recoverable material as possible.

The recent development of a MWP facility in Montgomery, AL, has been gaining much attention. The capabilities of this facility allowed the City to terminate its low-performing curbside recycling collection and rely on the facility to sort out saleable products. The City now claims to be achieving higher recycling levels than can be reached with even the best single-stream programs. Other cities, Indianapolis and Houston in particular, are also looking at this concept, motivated by two factors: significantly lower collection costs and a desire for greater levels of recycling.

As discussed recently in the media and the courts, a major point of concern with MWP is the quality of the end products, especially the paper products. Markets that convert recycled paperstock for food packaging appear especially concerned. It is the nature of technology to rise to the need of the consumer, as single-stream processing has done over the past 10 years and continues to do. Hopefully, MWP also will be able to respond appropriately to satisfy both the inputting customer and the end user. The larger concern should be the market for recovered commodities here in the U.S. We rely too heavily on exporting to other countries. As foreign nations grow their own economies, they will have an increasing internal supply of recyclables they can use and dial-down their demand for our trash. We should be doing more to create domestic demand—our own “Green Gate” to go through so we don’t have to worry about China’s “Green Fence”! We should do more to create domestic industries converting our recyclables to products we can buy locally. The result: more jobs, a more sustainable solid waste system domestically.

Emerging Conversion Technologies

There are proven waste-to-energy technologies that can produce steam, power, and hot and chilled water, but implementation of WTE in the U.S. is hampered by the relatively low value of the power produced therein. A grid sales price of approximately 6 cents per kilowatt-hour yields a per-ton revenue equivalent to $36. This simply is not sufficient to create a service fee that is competitive with land disposal, even to a landfill that is 50 or even several hundred miles away.

What about vehicle fuel, if power production is not profitable? Prior to the recent increases in domestically-available natural gas and oil, there was great popular and policy interest in boosting renewable fuel production, particularly for ethanol. The value of ethanol rose to more than $4 per gallon, inciting interest to make it from biomass as well as waste. Generally, waste-to-ethanol technologies can produce about 50 gallons of fuel per input ton of MSW. At the present value of approximately $2.50 per gallon, fuel production can bring $125 per input ton of MSW, which is more than three times the revenue from power production. And, if RINs are in play, an additional $0.60 to $0.70 per gallon can be added to the above values; or an additional $30 to $35 per ton. There are several companies advancing technologies to produce this higher value fuel product. Projects by Enerkem in Edmonton, AB, and Ineos in Indian River County, FL, are ones to watch, both for their present performance and their next moves.

Looking Forward

If the past is a good indicator of future behavior and performance, then the world of solid waste management will continue to evolve dramatically over the next few decades, influenced by a variety of factors that include everything from how we plan communities, rising costs and emerging technologies, to changing consumer behaviors and expectations. One of the biggest challenges communities will continue to face is their willingness and ability to pay for the new infrastructure needed to address the influences we’ve looked at today: the changing waste stream, challenges to land disposal, collection costs, evolving MRFs, and the opportunity for recovery of fuels or energy. In order for us to come out ahead on the other side of all this change, the public sector needs to find smarter ways for procuring infrastructure, such as offering long-term contracts in procurements that include project development assets. They also need to update or re-write solid waste management plans to provide, with specific details, for the creation of these projects. We will need bold Federal and state policies to ignite technological advancements and finally an engaged population that understands the implications of choosing low-cost solutions today in favor of the long-term sustainable solid waste management future that will cost more.

Harvey Gershman is President of Gershman, Brickner & Bratton, Inc. (Fairfax, VA), solid waste management consultants. Harvey became interested in this field because of Earth Day 1970 and has been an advisor to this field for more than 40 years. He can be reached at [email protected].

Notes

- U.S. EPA projects the lower amount, BioCycle Magazine’s State of Garbage projects the higher amount; George Carlin might have said, “That’s a lot of stuff!”

- Methane will cause 21 times as much warming as an equivalent mass of carbon dioxide over a 100-year time period. U.S. EPA, http://www.epa.gov/climatechange/ghgemissions/gases.html.

- http://www.epa.gov/climatechange/ghgemissions/gases/ch4.html

- Governmental Advisory Associates, Inc., 2015 data.