Tank car mileage equalization can affect profitability of rail shipments. Better understanding of the rules and regulations creates a mechanism for a company to better manage the outcome.

Darell J. Luther

Moving loaded railcars from a specific origin to a specific destination derives the preponderance of railroad revenue. However, in the case of tank cars, railroads also charge for that portion of empty miles that are in excess of 6 percent of loaded miles. This is considered empty non-revenue mileage that railroads believe are caused by shippers, Lessors or Lessees moving empty tank railcars to reposition railcars to other loading points, railcar shops or to railcar cleaning facilities. Railroads correctly reason that they expend additional manpower, fuel, locomotive resources and administrative costs and these must be recouped at a reasonable rate.

Railroads may also move empty railcars back to loading points using routes different than the route used to ship the railcar unbeknownst to the shipper. This may be for a number of reasons, including derailments, floods, diversions, traffic congestion, terminal switch capabilities, etc.—all of which are classified as railroad convenience. Regardless of the excess empty miles this causes, the railcar mark owner is responsible for any excess mileage charges.

Mileage Reporting

Mileage reporting for individual railcars is sent annually to the railcar mark owner. In the case of railcar leasing companies, a Lessee can request or will automatically receive the previous year’s mileage reports within three months after the end of the last calendar year. Mileage reporting from the railroads sent to the railcar (or railcar mark) owner is delayed three months due to the required processing time by the railroads. Railroads have up to two years to adjust Mileage Equalization reports and collect additional fees or reimbursement over charges to railcar mark owners.

Tank railcar shippers should keep track of their loading records and compare these loadings, any diversions to other loading points, and railcar shops or railcar cleaning tracks with railroad loaded and empty mileage reports. Many companies have enterprise software that integrates order fulfillment processes with logistics processes. These software packages generally have capabilities to generate historic mileage reports that can be used for mileage comparison purposes. Tank railcar owners should also generate reports with this enterprise software identifying empty route miles moved per railroad convenience. Although the railcar owner is ultimately responsible for any empty railcar mileage overage, one can sometimes successfully argue any charges attributable to railroad convenience.

Minimization of empty excess mileage may be accomplished by following these guidelines:

- If you don’t have enterprise software that enables monthly mileage reporting, consider using a third party service provider to obtain mileage information. Obtain mileage reports monthly measuring trends so that you can correct or proactively react to any excess mileage expectations.

- Provide full and complete routing on your billing when issuing disposition of loaded tank railcars. Unless you specifically request a diversion, the railroad will return the railcar by reverse route to the original loading point, which in turn equalizes your mileage.

- Given a choice between two railroads, use the more efficient one. Not only is this a good service choice its generally the most economical overall choice.

- Understand diversions and how they work. In many cases the railcar will go to the original loaded or empty destination and then be rerouted. Consideration must be given to diversion points generally identified as the last switchyard the train (railcar) can be re-switched to a different destination. To understand the diversion requirement of a specific railroad is dependent upon that railroad’s willingness to communicate their diversion rules and regulations to you.

- Understand the mileage footprint you are going to create in advance of any contract negotiations. If it will generate adverse conditions to mileage equalization, attempt to negotiate out any excess mileage charges.

- After-the-fact complaints and negotiations sometimes prove successful when the railroad(s) are presented with well documented movement records identifying either service disruptions requiring tank railcar movements that generate excess mileage or movements for railroad convenience. One can either use the railroads formal claim process or communicate directly with your railroad sales or marketing representative.

The Details

Railinc, which is the tariff publishing and record-keeping subsidiary of the Association of American Railroads (AAR), publishes Freight Tariff RIC 6007-N that governs mileage allowances, payments and charges. Supplement 23 to FT RIC 6007-N effective September 1, 2013 lists numerous items that cover mileage payout and mileage equalization and exceptions by participating railroad. Of note are some Shortline and Class I railroads for certain stations that do not follow the provisions of this tariff and/or do not subscribe to each individual tariff item. Albeit too numerous and site specific to recite here, they can be found in RIC 6007-N Supplement 23.

Item 187-E specifically addresses equalization of mileage on tank cars of private ownership. This Tariff Item consists of four specific parts and numerous subsections as follows:

- Part A. Aggregate empty mileage versus loaded mileage:

- Should aggregate empty mileage accumulated by tank cars carrying any of the reported marks assigned to any one person or company during the calendar year exceed the aggregate loaded mileage during the same calendar year by more than 6 percent, such excess mileage must be paid for by the person or company to whom the reporting marks are assigned at the rate of 82 cents per mile.

- Mileage on empty cars moving on revenue billing will not be included in the equalization account.

- Empty mileage accumulated on cars moving to and from repair facilities under DOT mandated retrofit programs or for inspection and/or repair under certain FRA, O&M Circulars or AAR Circular Letter(s) will not be included in the equalization account.

- Except as otherwise outlined no adjustments will be made in the equalization account for mileage caused by handling error, cars moving on their own wheels to and from repair facilities, mileage accumulated due to longer routes for railroad convenience.

- Adjustments will be made in the AAR equalization account for apparent accounting errors due to reporting errors. Private car owners may also request a mileage adjustment with proper mileage documentation.

- Aggregate loaded and empty mileage will be computed on the basis of actual distance.

- Part B. Reporting of actual loaded and empty mileage:

- Each participating carrier will submit a monthly mileage report to the assignee of each reporting mark 40 days after the close of the movement month reporting by individual car number the actual loaded and empty miles moved as well as loaded and empty miles accumulated by all cars bearing each reporting mark.

- Part C. Change of ownership:

- When a change of ownership occurs, the previous owner shall be responsible for loaded and empty mileage and be required to settle any outstanding mileage accounts.

- Part D. Annual national equalization accounting;

- After May 20 of each year, the AAR will summarize all empty and loaded mileage by reporting mark. Should aggregate empty mileage exceed the aggregate loaded mileage by more than 6 percent for any such group of reporting marks the company assigned the reporting marks will be billed at the rate of 82 cents per mile.

- An annual national equalization statement will be tendered by the AAR the private mark owner no later than July 1 of the year succeeding the equalization year.

- Any private car company failing to render complete payment within 30 days of the date tendered will be subject to penalties.

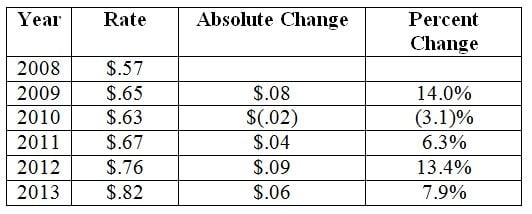

The 82 cent per mile charge for excess empty mileage is subject to revision September 1 of each year and will be retroactively applied to cover the entire calendar year involved. Historical mileage rates are depicted in Table 1.

Tank car mileage equalization is yet another detailed item that can affect profitability of rail shipments. While complex, it first needs to be understood and then to the degree possible accounted for in shipment requirements. Better understanding of the rules and regulations of tank car mileage equalization creates a mechanism for a company to better manage the outcome.

Darell Luther is president of Forsyth, MT-based Tealinc Ltd., a rail transportation solutions and railcar leasing company. Darell’s career includes positions as President of DTE Rail and DTE Transportation Services Inc., Fieldston Transportation Services LLC, managing director of coal and unit trains for Southern Pacific Railroad and directors positions in marketing, fleet management and integrated network management at Burlington Northern Railroad. Darell has more than 24 years of rail, truck, barge and vessel transportation experience concentrated in bulk commodity and containerized shipments. He can be reached at (406) 347-5237, via e-mail at [email protected] or visit www.tealinc.com.

Table 1

Historical mileage rates.

Image courtesy of Tealinc.