Take the time to really get educated on EPR details and ensure you engage in legislative debates for your state on bills as the devil is in the details. When it works, it can be the best policy approach for a range of products.

Heidi Sanborn and Christine Flowers

There are now more than 80 Extended Producer Responsibility (EPR) laws on the books across the country benefitting the economy, public health and the environment. Maine has the first, and so far the only, EPR framework legislation in the U.S. The law delegates authority to the State’s environmental agency to pick products to be considered by the legislature for new EPR programs, where producers are responsible for funding, designing and operating take-back systems. Unfortunately, the implementation has been bogged down in politics and besides paint—which was passed independently of the framework law—the State has not added a new product to the program in four years.

California and other states are probably not ready for EPR framework legislation until they see more product EPR legislation begin to work. In addition to the one “Framework” law, there are more than 80 EPR laws in 32 states for product types including electronics, mercury thermostats, carpet, cell phones, fluorescent lighting and agricultural pesticide containers. When bills are in the legislative process it is critical that all stakeholders participate in the debates and especially important that local governments can quickly advocate for EPR because they often have the most to benefit not only in shifting some costs, but in meeting public demand for recycling and collection programs. In order to ensure local governments could move quickly to weigh in on legislation, in California, CPSC facilitated the adoption of 137 EPR resolutions by local jurisdictions and organizations supporting product stewardship and most delegate to staff authority to advocate for statewide producer responsibility legislation and policies. We want all parties to be heard in developing any EPR system. As more EPR legislation is introduced, we want to share some trends and issues to be aware of no matter where you live.

Trends Towards Non-Hazardous but Problematic Products

EPR is used to address all kinds of manufactured products around the world from cars, to packaging and pharmaceuticals. In the U.S., the push for EPR started with products that contained hazardous materials such as mercury thermostats, electronics and paint, and there are 23 states with EPR laws on electronic waste except California which passed the first e-waste law which is a government managed Advanced Disposal Fee policy according to the Electronic Take Back Coalition. Starting in 2010, problematic products such as carpet and mattresses, which are bulky, difficult to manage, illegally dumped, take up landfill space and/or have large greenhouse gas footprints, passed in California.

In California, the product legislation trend since 2004 has clearly gone from solely addressing hazardous products in legislation to more problematic products and from ADF and retailer take-back policies to EPR: E-waste (2003 – Advanced Recycling Fee, government designed and operated program), Rechargeable Batteries (2006 – retailer take-back), Cell Phones (2006 – retailer take-back), Mercury Lamps (2007 and 2009), Agricultural Pesticide Containers (2008 – EPR), Mercury Thermostats (2008 – EPR), Carpet and Paint (EPR 2010) and Mattresses (2013 – EPR). In addition, with Connecticut passing Mattress EPR legislation in 2013, nationally we are seeing a movement towards EPR for non-hazardous products in the U.S.

Trends in Product Waste Management Costs

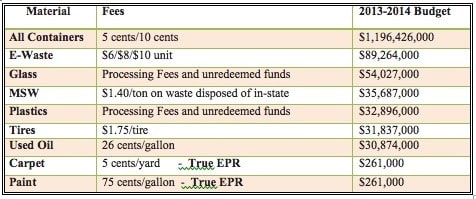

When the government is not tasked with designing and operating the product waste management program, but to oversee and enforce the program and often have those costs covered by the producers, the public cost is significantly less. In the February 2013 publication Beyond Waste, by Edgar and Associates, Inc., the point is made that the funding source and fund management will be part of the ongoing debate on whether to continue to promote state managed ARFs or to promote EPR where end of life management costs are born by producers with government role being oversight. As shown in Figure 1 developed for Beyond Waste for the proposed California 2013-2014 Budget, the bottle bill, ewaste, and other programs where the program and fund is managed by the state, the budget is in the millions, but the two EPR programs were only $261,000 each of the state budget—and those costs were reimbursed by the producers. In essence, EPR ensures that producers pay for the lifecycle of their product, not externalize those costs onto state and local governments. In reality, it is not 100 percent of the costs, as both paint and carpet programs are designed so that if collected by local governments, the products will be recycled but the overhead costs to collect the products are not reimbursed so we suggest that EPR is really a shared responsibility policy even though producers have primary responsibility.

California local governments are seeing real cost savings too. For example, three local governments operating household hazardous waste programs are seeing big savings with the PaintCare program—$200,000 for Kern County in southern California, $70,000 for Mendocino County on the north coast and more than $350,000 for Santa Clara County in the South San Francisco Bay Area. In addition to the benefit of cost savings for local government and the producers paying for State oversight, the public now has many more convenient recycling locations for paint with 534 new retail take-back locations added since October 2012. So, with more public convenience for recycling, cost savings for state and local governments, and more sharing of responsibilities, we think EPR can be a great model for some hazardous or problematic products—but the devil is always in the details.

Trends in EPR: Pharmaceutical and Sharps

Unused pharmaceuticals and sharps are first and foremost a public health issue no matter whether you classify them as hazardous, problematic, or not, which is why we think they are appropriate product types for the EPR policy model. Home generated unused medications and used needles and lancets (collectively referred to as sharps) pose unique challenges for end of life management. The use of prescription drugs has risen steadily in the U.S., to the point where 70 percent of Americans are now taking at least one prescription medication and many who become addicted start by taking them unknowingly from friends and family. Some unused medications stay in medicine cabinets, some end up flushed down the toilet, and others end up in the hands of young people or criminals. Sharps are a public safety issue too. The Food and Drug

Administration estimates that each year 3 billion needles and 900 million lancets are used in U.S. homes each year and without a convenient and free way to safely manage them, they end up in the trash or recycling containers, which can stick solid waste workers and some are flushed into water treatment system risking needle sticks for those workers. Canada has had EPR for medications and sharps for more than 10 years in some provinces and is showing great success with the Ontario program in its first year. So why don’t we have EPR for pharmaceuticals and medications in the U.S. if we have an epidemic of prescription drug abuse and increasing risk of needle sticks?

Local government decided to take action first with the Alameda County Safe Drug Disposal Ordinance of 2012. The legislation requires pharmaceutical companies to design, fund and operate a safe medicine collection and management program which could operate like the take-back programs found in Canada’s pharmacies, which are paid for by drug companies and operated by the Canadian Health Product Stewardship Association on their behalf. In the 2013-2014 legislative session, EPR bills were introduced in California for both sharps and medications and neither passed. While both bills resulted in vigorous debates on the problems and potential solutions, only one company broke the ranks to support it and that was Ultimed which is one of five sharps producers. Not one pharmaceutical company or association supported an EPR model even though they operate them in Canada and other European countries with great success. Meanwhile, the Alameda County Safe Drug Disposal Ordinance which passed in 2012 and was soon followed by passage of a very similar ordinance in King County Washington in 2013, and both were challenged by three associations of drug producers including PhRMA. The first court upheld Alameda’s ordinance.PhRMA and the other associations appealed to the 9th Circuit Federal AppealsCourt in San Francisco, which held a hearing July 11, 2014. The video of thehearing is worth watching, as the court is going to decide whether any countyor local government can pass legislation that will make the manufacturers ofpharmaceuticals or any product, share in the responsibility for its lifecycle costs.

Judge N.R. Smith commented on the plaintiff’s minimal effort to show burden by saying “I was really surprised that one really didn’t take up the burden very much [ … ] I didn’t even see any evidence the ordinance would interrupt or even decrease the flow of goods to the county [ . . . ] But of course, with $965 million in sales, maybe that wasn’t such a good argument to make with only $1 million.” At any time the court could rule and if it finds for Alameda, PhRMA could choose to appeal to the Supreme Court.

In short, we believe that it is time for EPR for sharps and pharmaceuticals and if the State and federal governments fail to act, the local governments will act due to public health and safety concerns—as long as the 9th circuit court rules in favor of Alameda.

National Discussion on Packaging EPR Starting

The national discussion about packaging is important; however, it is more complicated than a single product category. In Belgium for example, the packaging EPR program managed by Fost Plus has more than 5,800 producers paying into the program. There are many producers and material types in the packaging category not to mention existing markets for some packaging materials. This product category will require significant forethought and stakeholder input to ensure it would work well in the U.S.

Summary

EPR is a relatively new policy model for the U.S.—we are just getting used to this paradigm shift where local governments are not the only party responsible for reaching recycling goals. We are learning with each law that passes what to expect of the producers, what legislative language results in adequate stakeholder consultation, and what environmental, convenience and cost sharing goals can be reached. As previously mentioned, with any policy, the “devil is in the details” and we urge more people to take the time to study

EPR programs and actively participate in legislative debates in your state and provide input after they pass. We believe in EPR—but we also know that simply turning over the keys to the program to the industry without proper stakeholder input, transparency, accountability and government oversight authority can lead to problems. But when it works, it may be the best policy approach for a range of products, hazardous or not.

Heidi Sanborn is Executive Director of the California Product Stewardship Council (Sacramento, CA). She can be reached at Heidi Sanborn, [email protected].

Christine Flowers is Program Manager for California Product Stewardship Council. She can be reached at [email protected].