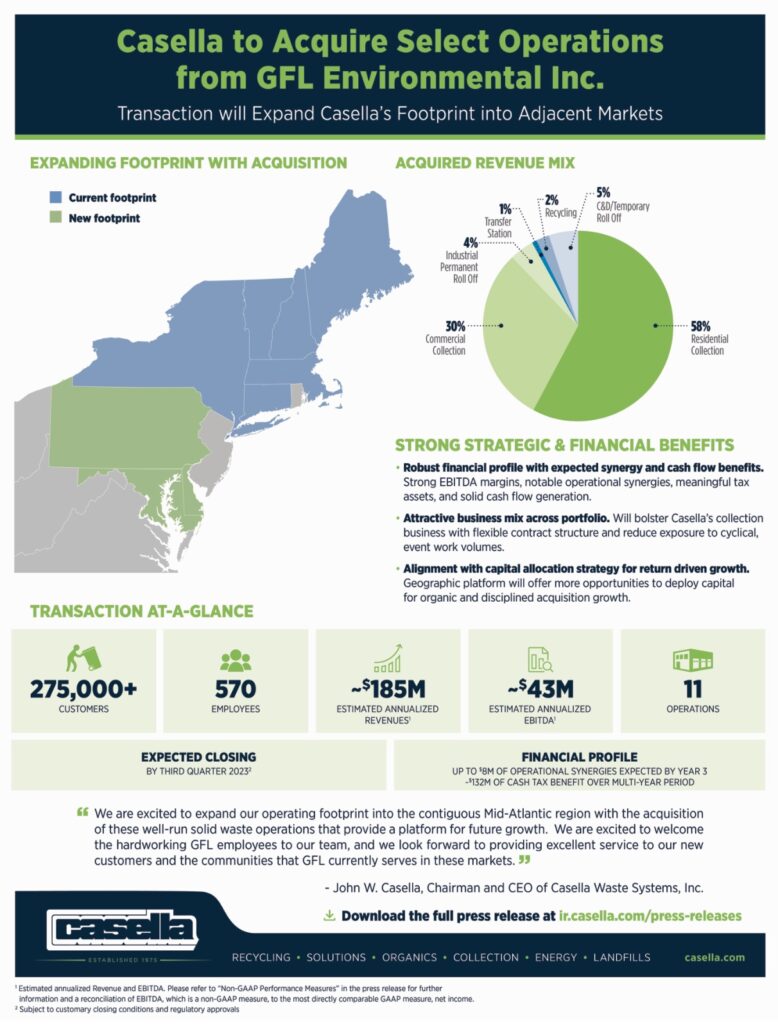

Casella Waste Systems, Inc. announced the signing of an equity purchase agreement on April 21, 2023, to acquire collection, transfer, and recycling operations in Pennsylvania, Delaware, and Maryland from GFL Environmental Inc. for a purchase price of $525 million. The proposed acquisition includes nine hauling operations, one transfer station, and one material recovery facility with aggregate annualized revenues of approximately $185 million. The acquisition is expected to close by the third quarter of 2023, subject to customary closing conditions, including regulatory approvals.

“Today’s announcement marks an important step forward in the company’s growth strategy by using the strength of our balance sheet and proven capital discipline to make a compelling investment,” said John W. Casella, Chairman and CEO of Casella Waste Systems, Inc. “After successfully extending our footprint into the adjacent Connecticut market with an acquisition in mid-2021, this acquisition will enable us to expand into the Mid-Atlantic region with these well-run solid waste operations that provide a platform for future growth.”

“We have worked with the GFL team to conduct extensive due diligence and to start a collaborative integration and transition planning process,” Casella said. “Over the last five years we have built a strong team focused on successfully integrating and driving returns from acquisitions. In addition, our existing team includes several talented professionals who have experience with these specific operations and markets, which provides us even more confidence around a successful integration process to drive further shareholder returns.”

“We look forward to welcoming the hardworking GFL employees to our team,” Casella said. “And, we look forward to the opportunity to provide excellent service to our new customers and the communities that GFL currently serves in these markets.”

Strong Strategic and Financial Benefits

- Expands footprint into contiguous markets for additional growth opportunities. The pending acquisition of solid waste assets in the Pennsylvania, Maryland and Delaware markets is a natural extension to Casella’s existing footprint in the Northeast and offers future organic and inorganic growth opportunities. Casella’s resource management approach to providing value to its customers through sustainable solutions represents great potential to grow its commercial and industrial segments.

- Robust financial profile with synergy and cash flow benefits. The operations and transaction structure are expected to provide solid financial benefits that will help to drive continued strong cash flow growth. Casella expects the acquired operations to generate approximately $185 million of revenues and $43 million of EBITDA1 during the first 12-months. In addition, Casella expects to generate approximately $8 million of incremental annual synergies and benefits by year three of operations through internalizing certain volumes into its disposal network and capturing fleet automation efficiencies. Further, given the structure of the transaction, it is expected that the acquisition will create significant cash tax benefits to Casella, estimated to be greater than $130 million of savings over a multi-year period.

- Attractive business mix across the portfolio. Approximately 80% of the revenues to be acquired are currently generated in the open market from commercial collection and subscription residential collection customers. Further, approximately 5% of the revenues to be acquired are currently generated from construction and development activity which is expected to further reduce exposure to more cyclical and event-driven lines of business on a consolidated pro forma basis.

- Alignment with capital allocation strategy for return driven growth. The transaction is consistent with Casella’s 2024 strategic plan of opportunistically deploying capital at strong, risk-adjusted return levels to create long term shareholder value.