Waste and recycling companies should evaluate their basic logistics plan, including where you ship from and where you ship to. It is an ongoing effort and even after a plan is implemented, tedious care must be given to maintaining transportation options.

By Darell Luther

Location, location, location—the mantra of many a real estate professional—holds true to rail and truck shippers and receivers. Many shippers are faced with transportation charges that range from a high percentage to a cost that far exceeds the value of the product they are shipping or receiving. It seems egregious that the cost of simple transport of a product can be higher than the value of the product. So, what has location got to do with this? Everything!

Most shippers and receivers are locked in to their location. The capital infrastructure, water and electrical requirements, permitting, current land restrictions and, in some cases, lack of available land resources restrict a potential shift in location. However, it does not mean that from a transportation perspective you cannot shift your transport options via a transload operation, rail build out, a change in routing or other means. Why does this really matter?

We get a chance to view a lot of rail rates on behalf of clients and even truck and barge when we look at multi-modal shipments.1 These rates tell us that a competitive alternative is often worth hundreds to thousands of dollars per load transported. By a competitive alternative, we mean dual or triple access by rail carriers’ availability to transport by rail or truck—transload alternatives. On average we see a difference of around 15 to 20 percent in the cost of transportation between competitive and captive options.

Waste and recycling companies can explore these options by evaluating their basic logistics plan, i.e. where do you ship from and where do you ship to? Oftentimes waste and recycling companies by their very nature are located in more population dense areas. These areas generally have more than one rail carrier serve them thus providing transload or new build opportunities that can be used to realize transportation cost gains. In the pure municipal solid waste (MSW) industry the waste is generally gathered by haulers then taken to transfer sites or established shipment yards. Since the MSW is on wheels it can be rerouted to other potential sites that allow access to alternative rail carriers. It is just a matter of finding a willing carrier that can create a competitive situation. Let’s look at a real-life example of these alternatives for a captive shipper.

Example for Determining Rail Rate Cost Alternatives

In this example, the rail shipper is captive on a major Class I and ships via Class I railroad interchange to another Class I with a shortline railroad terminating the movement. The movement is Class I to interchange to Class 1 to interchange to Shortline railroad. The origin of the product is not located on rail at the present time and is trucked to the originating Class I via the closest highway miles, minimizing trucking costs as much as possible. The movement has a host of interchange selections but the actual interchange is being driven by the originating Class I without regard to overall cost to the shipper. The final rate has been quoted on what is called a “through rate” (defined as a rate applicable from point of origin to destination and may be a joint rate with other carriers or a combination of two or more rates) basis where the originating carrier collects the transport costs for all three carriers and does an interline settlement with them.

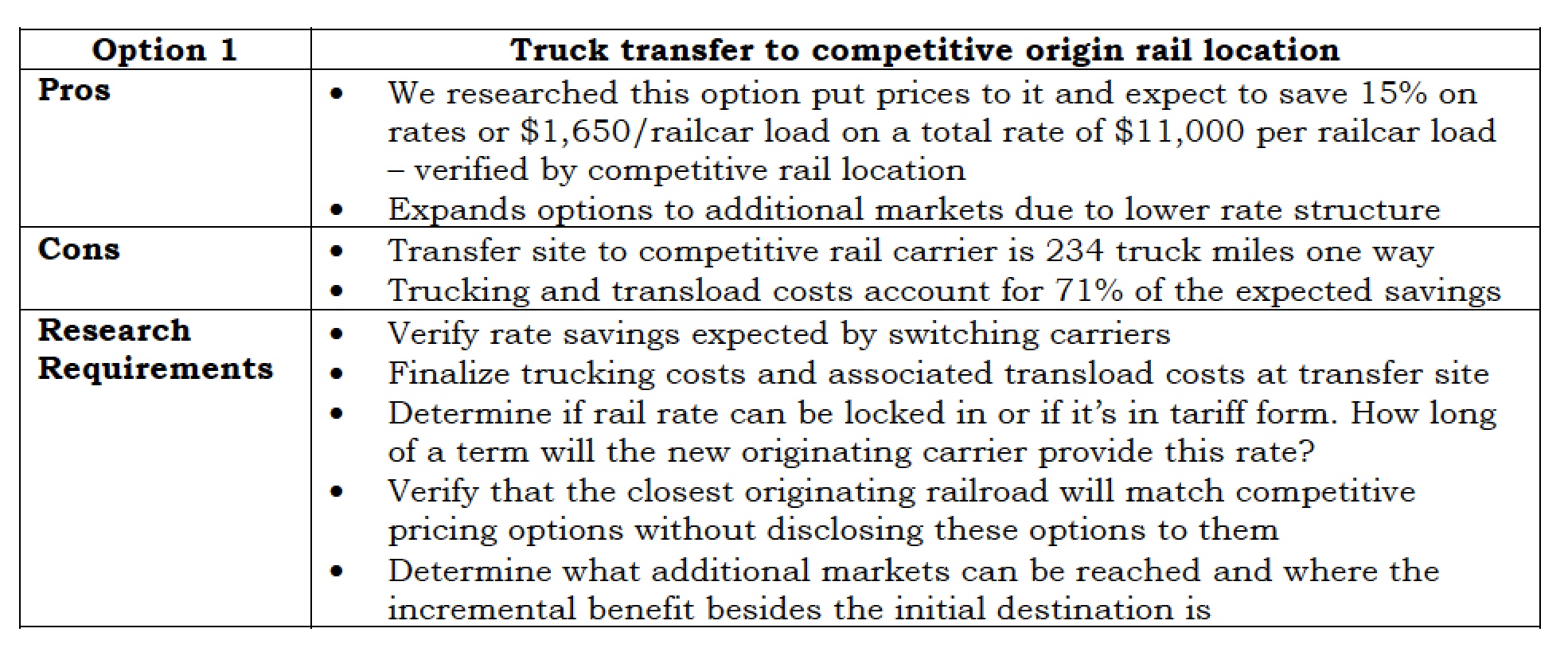

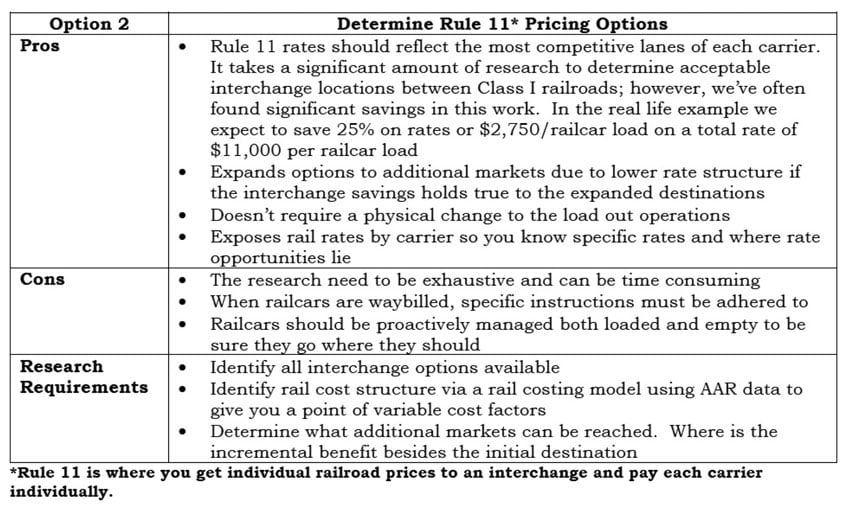

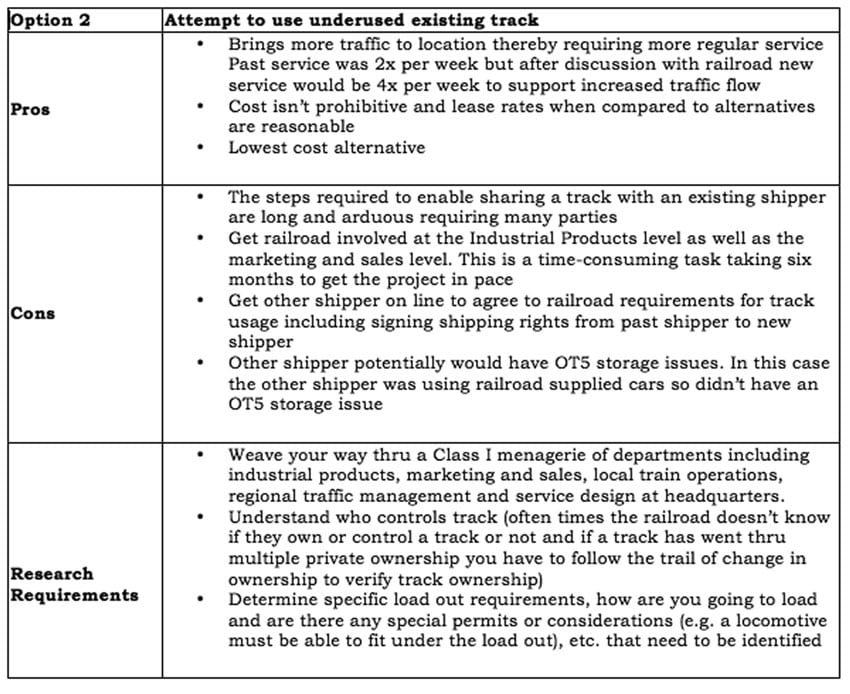

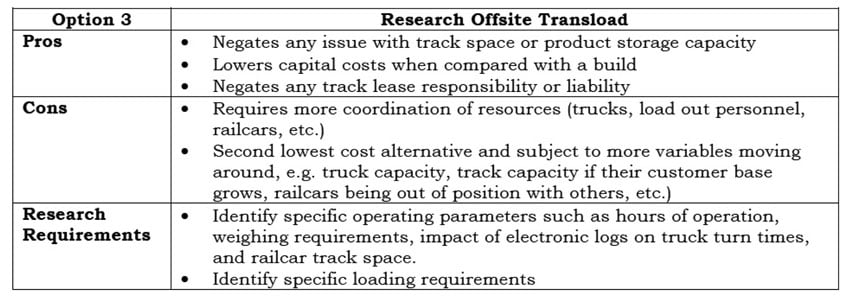

We will explore the footwork we go through to determine what options the shipper has available. The pros, cons and research requirements of the options we considered are below.

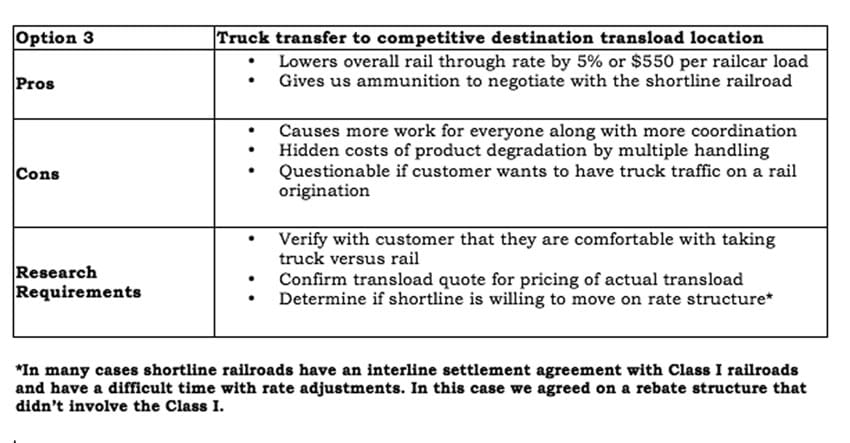

Much the same as the truck transload at origin you may want to look at the same for the destination. The previous Rule 11 work should expose individual railroad costs and in this case we found the shortline costs excessive on a miles per ton mile basis.

Exploring Loading and Destination Site Alternatives

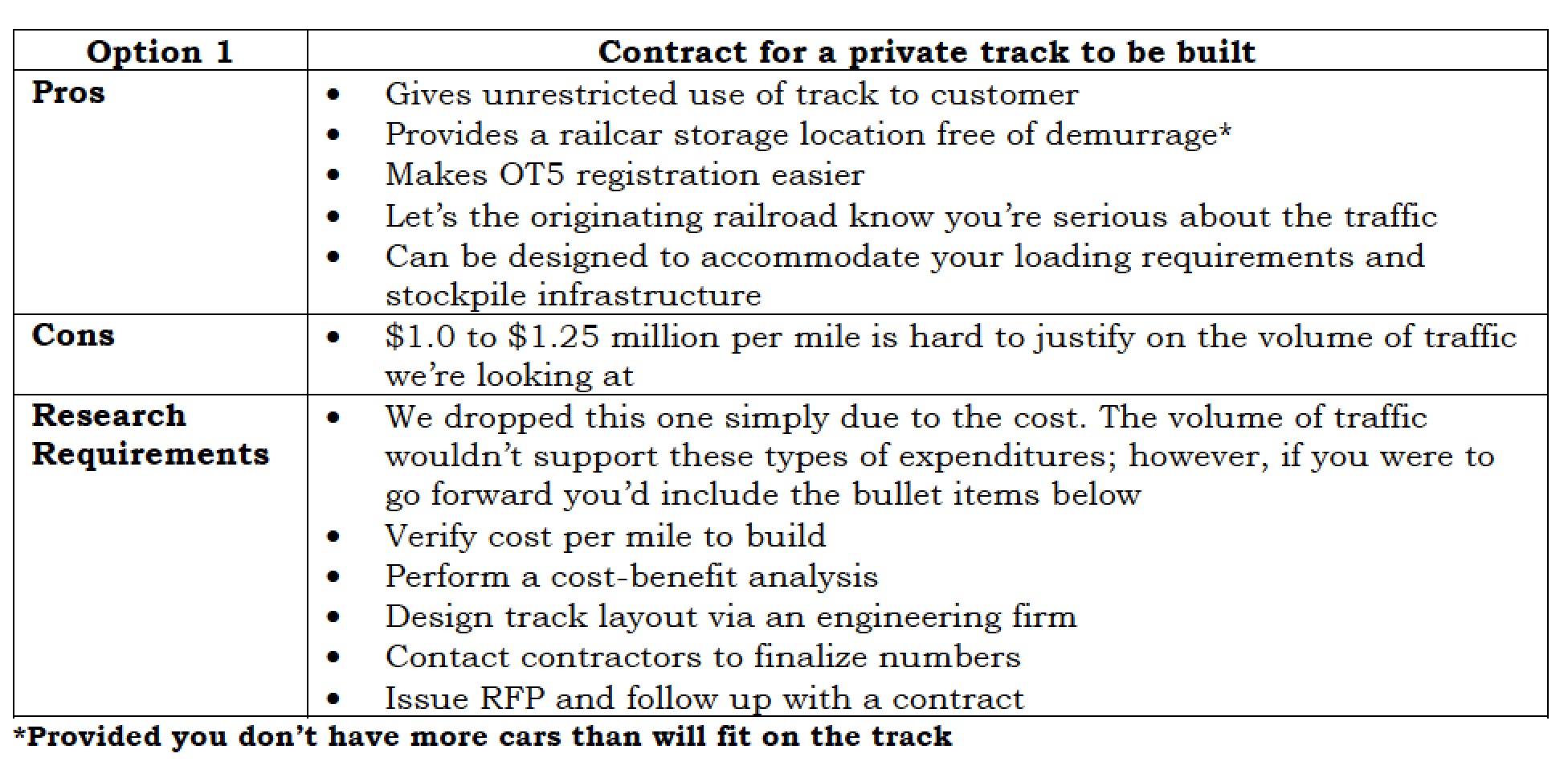

On most Class I railroads when it comes to sharing loading sites there cannot be more than one shipper per private or railroad leased track unless the track has been designated a team track for use by multiple tenants that all agree on the use structure or an actual transload site. What makes this problematic is that there are very few unused tracks in the rail system today making access for a private shipper looking to ship from a private or railroad leased track difficult. In our case we explored several alternatives including sharing a track nearby that was being underused to transloading at another industrial track that was privately owned to trucking to a transload site 234 miles away. The other alternative we did not explore here, but may want to consider, is to complete a track build-out so that we would have our own private track; however, at a high-level cost of $1.0 to $1.25 million per mile one might quickly take that option off the table. Our exploration of options included the following.

From a rail rate standpoint, the offsite transload pros and cons are addressed above. Following, we will talk about how we evaluated it from an operations standpoint.

Review the Situation

The examples above are real life examples from a recent project we have been a part of. While it is fun to look back and be able to claim success, it is very much an ongoing effort and even after a plan is implemented, tedious care must be given to maintaining transportation options. Rates change, interchanges become more or less fluid, routing moves around and those things on the outside such as accessorial tariffs become more restrictive. Be sure to do an in-depth review annually and if you do not have time to review the situation in depth every year, then consider outsourcing the project. You might be surprised what you find out.

If you are lucky enough to be establishing a greenfield site, we recommend you strongly consider the transportation component of the overall operating cost of the project. Remember transportation costs often exceed the value of the product.

Darell Luther is CEO and founder of Tealinc, Ltd. (Forsyth, MT). He has also been President of DTE Rail and DTE Transportation Services Inc., President and co-founder of Fieldston Transportation Services LLC, President and founder of Focus Transportation Services, Managing Director of Coal and Unit Trains for the Southern Pacific Railroad, and has had Directors positions in marketing, fleet management and integrated network management at the Burlington Northern Railroad. Darell has nearly 32 years of rail, truck, barge and vessel transportation experience mostly concentrated in bulk commodity and containerized shipments. Darell’s vast comprehension of the logistics chain, phenomenal leadership skills, industry knowledge and ability to think creatively has propelled Tealinc’s dynamic success. He can be reached at (406) 347-5237 or via e-mail at [email protected].