The financing options you choose and the resulting benefits will be unique to your business and financial needs.

By Ed Roberts

Now may be the time for your company to purchase equipment and take advantage of Section 179 or the 100-percent bonus depreciation benefit and other provisions included in the Tax Cuts and Jobs Act. These incentives may make upgrading equipment more economical, lower tax liability and potentially conserve working capital for other immediate business needs.

Section 179

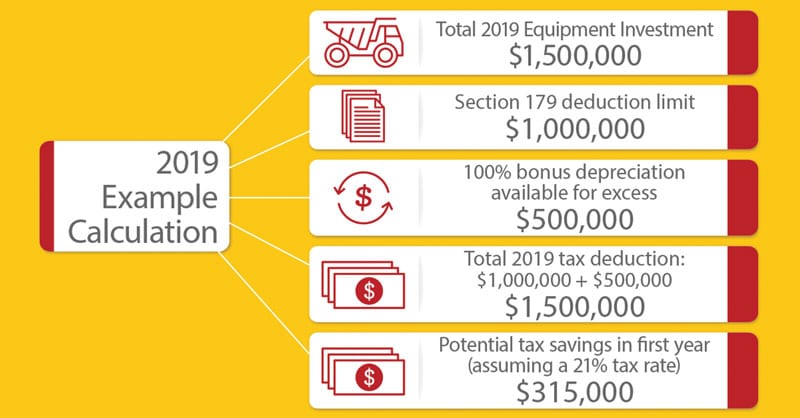

Section 179 allows businesses to deduct the full cost of qualifying new and used equipment from 2019 taxes up to $1 million. The ability to take deductions under Section 179 now begins to phase out for total equipment purchases in excess of $2.5 million. The phase out is on a dollar-for-dollar basis once equipment purchases exceed $2.5 million. Equipment must be purchased and placed into service by Dec. 31, 2019 (see Figure 2).

Evaluation and comparison of bonus depreciation and Section 179 are critical in tax planning for your business. Considerations include:

- Either deduction results in considerable tax savings for businesses that plan to purchase qualified property

- Bonus depreciation is not limited by the size of the business; neither does it restrict the benefits at a certain dollar amount

- Businesses with larger capital equipment investments might find benefits capped under Section 179 due to limitation on equipment investment at $1 million

- Bonus Depreciation is taken after the Section 179 deduction; this may benefit larger businesses spending more than the spending limit

- Businesses with a net loss in a given tax year qualify to carry-forward the Bonus Depreciation to a future year

- Many types of equipment may qualify, commercial trucks and trailers, landfill equipment and material handling

- Many leasing or financing options can be used while benefiting from the tax incentives.

Bonus Depreciation

Bonus depreciation is an optional tax-saving benefit that can impact your business in the first year. The Tax Cuts and Jobs Act increases the advantage of bonus depreciation, allowing businesses of all sizes to:

- Deduct the full cost of qualifying equipment purchased and placed into service by Dec. 31, 2022

- Deduct the full cost of used equipment that is “first use” by the business that buys it; bonus depreciation is not limited to new equipment (see Figure 1)

Potential Benefit of Leasing Equipment

If bonus depreciation deductions are not helpful to your company for the acquisition of new or used equipment because of your tax position, or if you own equipment that has been fully depreciated, you may still be able to benefit from attractive lease pricing. Bonus depreciation may be available to a lessor who can work with you to structure an equipment lease for newly acquired equipment (new or used) or through a sale-leaseback of your depreciated equipment.

Find a Lender Who Knows Your Business

In addition to understanding your financing options and associated benefits mentioned in the article, it is equally important to work with a lender who has industry expertise, including knowledge of business cycles, equipment needs and collateral situations. That type of lender can become a trusted provider that not only provides financing, but also helps business owners navigate crucial growth stages. Ultimately, the financing options you choose and the resulting benefits will be unique to your business and financial needs.

Ed Roberts has worked in the finance industry for more than 30 years sales and lending roles, supporting customers, dealers and manufacturers in the vocational and transportation industries. Based in Minneapolis, MN, he is a senior vice president for Wells Fargo Equipment Finance, Commercial Vehicle Group – Specialty Markets, including the U.S. waste, recycling, and vocational markets. He can be reached at [email protected].

*Opinions expressed in this article are general and not intended to provide specific advice or recommendations for any individual or association. Contact your banker, attorney, accountant, or tax advisor with regard to your individual situation. The author’s opinions do not necessarily reflect those of Wells Fargo Equipment Finance or any other Wells Fargo entity.