Waste-By-Rail

Managing the Details

As with any business decision, there is a lot of decision criteria required to make an informed decision, all of which need to be explored to the minute level of detail when moving waste by rail.

Darell Luther

Ever hear of the old saying, “the devil is in the details”? We all know it to be true and how the details are composed and managed generally affects the outcome on whatever it is you are working on. Over the past several months, the Waste-By-Rail articles have just touched on the details, yet remained high level enough to give you the overall picture of the topic being discussed. This month we’ll delve a bit deeper into the details on managing waste-by-rail and the decision-making process required to support and analyze those details.

What Are We Shipping?

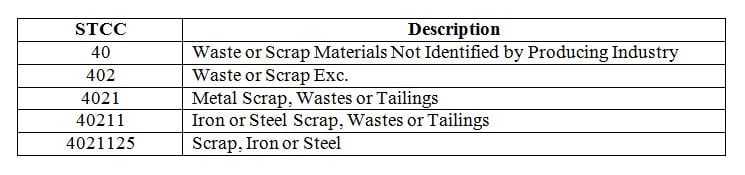

The definition of waste is generally in the eye of the beholder. In railroad speak it begins with the definition of the commodity under a universal system of classification called the Standard Transportation Commodity Codes (STCC). STCC are seven-digit numeric codes that represent 47 different commodity groupings. These commodity groupings represent more than 10,000 STCC and are maintained by the Association of American Railroads (AAR). They are generally based on the Standard Industrial Classification (SIC), but STCC and SIC have diverged over the years. Commodities are classified according to producing industry with the first five digits coinciding with an adaptation of the SIC published by the U.S. Office of Management & Budget as a mandatory reporting form for all regulated carriers. The sixth and seventh digits of the STCC give specific commodity identification.

Of particular importance to hazardous waste shippers is the Hazardous Material Response Code which is a unique seven-digit code used to classify a commodity or group of commodities that have hazardous waste response requirements specific to a commodity. The first two digits of a hazardous waste STCC are either 48 or 49. To continue with our mantra of working in the details Table 1 shows the STCC classification general schema that we’ll be using in this article.

Pricing a Shipment

Let’s say we want to ship a railcar loaded with scrap iron or steel wastes or tailings from Albany, NY to Atlanta, GA. There are a series of steps that should be followed to obtain the most current rate and railcar options available, including:

Finding rail stations and rail carriers

Researching price alternatives

Analyzing the results

Finding Rail Stations and Rail Carriers

The first step is to find the originating and terminating rail carriers. The easiest way to start this research is by visiting Class I Railroad Web Sites to identify which railroad carriers originate shipments at Albany, NY and which railroad carriers terminate at Atlanta, GA (see Class I Carrier Web Sites sidebar). Generally, in the eastern U.S. CSX and Norfolk Southern are the predominate Class I railroads, and in the western U.S. BNSF and Union Pacific are the predominate ones. These rules of thumb for originating and terminating carriers provide general overall geographic relevance. If you can’t find your originating or destination station, the easiest next step is to call an originating carrier customer service representative that you believe to be able to provide you rail service. There is also an official document called the Open and Prepaid Station List (OPSL) that lists every station and interchange between all rail carriers. It is a cumbersome tool and should not be used as a resource in identifying station lists. Just be aware that there is detail at this minute level. In our research we show a direct route from Albany, NY to Atlanta, GA on the CSX Railroad. We’ll use the CSX as our rail carrier to price out the movement.

Researching Price Alternatives

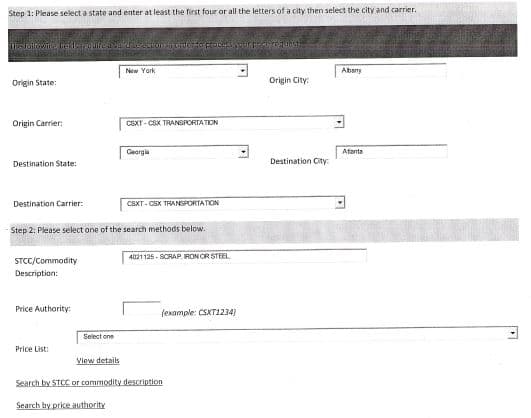

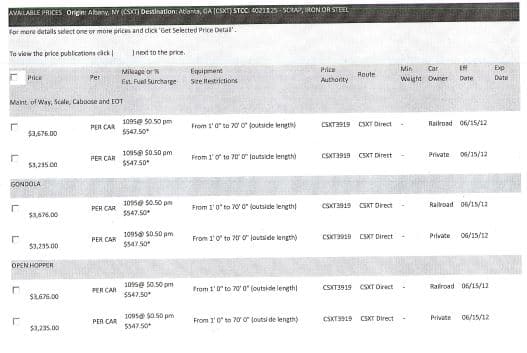

Generally, all Class I railroads give their customers and registered users online price inquiry capabilities. In this case Tealinc, Ltd is a registered user on CSX and has an account with www.Shipcsx.com. This gives any person with such an account a lot of research capability to compare and contrast rail pricing across railroads and with other transportation options. We know from our STCC research that the seven-digit STCC for the scrap, iron or steel that we want to ship is 4021125. We feed the information required into the CSX web page and select retrieve prices (see Table 2). After we retrieve our pricing we find several alternatives that are available to us (see Table 3). You’ll note on the table that there are two price alternatives for two different railcar types. The price alternatives are in per railcar shipment increments for either railroad provided or private railcars.

Specifically, if a railcar is railroad provided it is a railroad owned or controlled railcar provided for this specific shipment. You may or may not see the railcar again depending on the next best alternative the railroad has for it after your shipment. In the case of this shipment, as soon as the railcar hits Atlanta and is unloaded it is most likely to be redistributed in the Atlanta area first, then generally within a close geographic boundary to another shipper that can use the same railcar type for their product shipment. Railroad supplied railcars are great alternatives for shippers that are only shipping occasional railcars or the economics of the product sale and shipment don’t economically justify a shipper committing to a lease or ownership of railcars.

A private supplied railcar is one that you, as the shipper, provide the railcar(s) for the shipment of your product. In this case, you’d either need to purchase or lease the railcar from a railcar lessor or seller. A private railcar will automatically be reverse routed back to your loading location in Albany, NY unless you provide the railroad with an empty diversion to another loading location. Private railcars make sense if you have continuous ongoing movements of commodities that require a railcar with a specific physical and qualitative condition that optimizes your commodity movement.

You’ll notice the next line of demarcation is between railcar types. The CSX provides an option of gondola or open top hopper railcars with a wide range of equipment size options. Both railcar types can be loaded via multitude of ways e.g. frontend loader, conveyor, overhead gravity bin, etc. The real key is to determine destination unload capabilities before selecting a railcar type so that when the railcar reaches its destination it can be most efficiently unloaded.

The results contain other important information such as:

Mileage or Percent Estimated Fuel Surcharge. This is the rail mileage that can give you comparative mileage statistics or rates per ton mile comparative analysis. Fuel surcharges are added to the base rate and change independently of the base rate.

Applicable Equipment Restrictions. This field will denote most railroad restrictions including length of the railcar. It is important to be aware that additional restrictions including railcar height and gross weight on rail for each individual car may further to be specified when you are finalizing pricing and contracts for service with the railroad representative.

Price Authority. The particular tariff and the rules and regulations that accompany the move are contained in this document. It’s worth a read to see what you’re signed up for. In our case, Tariff CSXT 3919 provides the governing rules and regulations for our shipment.

Effective Date and Expiration Date. The time frame the tariff authority is in effect.

Analyzing the Results

The results of our inquiry yield identical freight and fuel surcharge rates from Albany, NY to Atlanta, GA for either private gondolas or private open hoppers and for either railroad supplied gondolas or railroad supplied open hoppers. The rate for railroad supplied gondolas or open hoppers is $3,676 per railcar shipped and the rate for private supplied gondolas or open hoppers is $3,235 per railcar shipped. Including a fuel surcharge for each move of $547.50 per railcar shipped, the rates are $4,223.50 for railroad supplied railcars and $3782.50 for private railcars per railcar shipped.

The railroad has priced the railcars used to ship our STCC 4021125—scrap, iron or steel—at a point of indifference. This leads us to our next point of analysis, which is to determine what railcar type best fits our shipment requirements and yields the best economics for our company? To do the decision analysis at this level it’s best to start with a list of questions and answers:

Can we load both railcar types?

If yes, then consider both railcar types

If no, then eliminate unworkable railcar

Can we easily unload both railcar types?

If yes, then consider both railcar types

If no, then eliminate unworkable railcar

What are the product considerations?

Does the product work in the specific railcar without leakage?

Do the railcars need any special mechanical considerations, e.g. sealed weep holes or door seals, tarp straps, lids, etc.?

Does the product bridge during unloading?

What does the product weigh per cubic foot?

What unloading requirements are necessary for the product?

Does the railcar require tarps or other covers for product protection?

What are the expected shipment patterns?

Is this a one-time move or sporadic movement?

Is the move ongoing and repetitive even possibly seasonal?

Is there value to the customer in having a railcar of product timely delivered?

What are the economics of the decision criteria?

What are the railroad-supplied railcar rates?

What is the reliability of getting the right railcar from the railroad?

What are the private railcar rates?

How many railcars will I need to ship the quantity of product in the timeframe desired?

What are the requirements to buy or lease a group of railcars sufficient to handle my commodity?

Applying the list of questions above to our situation of shipping scrap, iron or steel from Albany, NY to Atlanta, GA we have two resulting decision criteria. It starts with the physical railcar characteristics—you have to be sure the railcar will transport your product before going forward. The second criteria are whether to use a railroad or private railcar for your shipment.

Physical railcar considerations are important in that they help drive the overall economics of the shipment. In our example we have two railcar types with a myriad of physical characteristic options. Our selection criteria begin with product density and handling characteristics:

Is the product flow-able?

What does it weigh per cubic foot?

Does it tend to leak out of hopper gates? What are the cover requirements if any?

Does it bridge up when unloading?

Does it have hazardous commodity considerations that require special handling, etc.?

In our example movement, we know that with the inclusion of small fragments and dust, the commodity is flow-able and does tend to leak out of open hopper gates if they aren’t foamed. In addition, the destination does not have the capability to unload commodity from beneath the railcar. These two critical items disqualify open hoppers from being used in this movement.

Our next consideration is to determine what physical characteristics should a gondola have to optimize our per car rail rate. We know the product is flow-able so we have to cover the weep holes in the gondola but have the capability to remove them when the railcars are empty so we don’t create a large water retention vessel. If our shipment profile is sporadic or a one-time move, we can simply plug the holes with wood, metal, cloth or other material. If the shipment profile is ongoing, we’d want to apply a more permanent mechanical fix. We check the product shipment requirements in the applicable tariff (CSXT 3919) and find that the product does not require the railcar to be covered. We can unload the railcar with an excavator or a track hoe that climbs across the top of the railcars.

We also weigh our product and find that it’s relatively heavy at 80 pounds per cubic foot. Our shipment originates on a shortline that is a CSX reporting railroad. For pricing purposes, the movement shows CSX as the only route but physically the movement is originated on a shortline railroad. The originating shortline railroad has certain line restrictions at the origin allowing a maximum of 263,000 lbs. gross weight on rail. This restricts our gondola railcar to the same criteria. Basically, a mill gondola railcar will be able to transport 100 tons (200,000 pounds) of commodity with a light weight of 60,000 to 63,000 pounds (railcar weight). In our case we know our commodity weighs around 80 pounds per cubic feet. Doing the math, we arrive at an optimal car cubic capacity of 2,500 (200k/80lb ft3) at 263,000 lbs. gross weight on rail. Mill gondolas come in varying sizes and capacity, but a popular size is 2,494 cube at approximately 100 tons capacity for a maximum 263,000 lbs. gross weight on rail, resulting in the optimal railcar for this movement.

Our next analysis is to determine whether to use railroad supplied railcars or lease private railcars. Our shipment is relatively steady at the rate of five railcar loads per month. Since we’re shipping from a processing facility, the reliability of railcar supply is important to keep the product moving to the destination in a relatively steady fashion. The difference between the railroad supplied and private railcar rate is $441 per railcar. We check the market and find that railcars that fit our profile lease for a range of $300 to $350 per railcar per month net, meaning that as the lessee, I’ll be responsible for the maintenance, insurance, transportation and taxes for the railcar while it’s under lease. Mobilization into service and the permanent mechanical changes to fix the weep holes will result in an additional $25 per railcar per month. We check our shipment cycle time and find that a normal shipment pattern averages 30 days loaded and empty return. Hence, our cost of leasing railcars is around $375 on the outside. In a very simplified fashion, netting a benefit to leasing railcars versus relying on railroad supplied railcars of $66 per railcar per month plus increasing the reliability of meeting our customer shipment requirements. In this scenario, a decision to lease private railcars appears to provide us with the most economical and efficient waste-by-rail solution.

Shipment Analysis Conclusion

As with any business decision, there is a lot of decision criteria required to make an informed decision, all of which need to be explored to the minute level of detail when moving waste by rail. After all, “the devil is in the details” leads to positive results.

Darell Luther is president of Forsyth, MT-based Tealinc Ltd., a rail transportation solutions and railcar leasing company. Darell’s career includes positions as president of DTE Rail and DTE Transportation Services Inc., Fieldston Transportation Services LLC, managing director of coal and unit trains for Southern Pacific Railroad and directors positions in marketing, fleet management and integrated network management at Burlington Northern Railroad. Darell has more than 24 years of rail, truck, barge and vessel transportation experience concentrated in bulk commodity and containerized shipments. He can be reached at (406) 347-5237, via e-mail at [email protected]or visit www.tealinc.com.

Sidebar

Class I Carrier Web Sites