Having a tight set of leading and lagging indicators monitors the performance and costs of maintenance operations with considerably more granularity and precision.

By Preston Ingalls

We spend millions maintaining our equipment, but how do we really know it is a meaningful investment? After all, what do we take as visible indicators of success? What we are missing is a good balance of leading and lagging KPIs (Key Performance Indicators) focused on measuring equipment maintenance effectiveness or asset management. This means indicators or metrics that not only show your activity, but also the results of that activity to answer the question: Are we managing the management of our assets prudently?

Lagging indicators are typically output-oriented measuring results. These are often easy to measure, but hard to improve or influence. On the other hand, leading indicators are typically input-oriented, hard to measure and easier to influence. They change before lagging ones do and usually result in lagging indicator actions. A good way to think of the balance between the two is cause and effect.

It is recommended that any maintenance operation have at least 15 to 20 metrics to track leading and lagging KPIs with 20 to 25 providing more granularity. A basic set of input categories are Capital, Labor and Materials (CLM).

Figures courtesy of TBR Strategies.

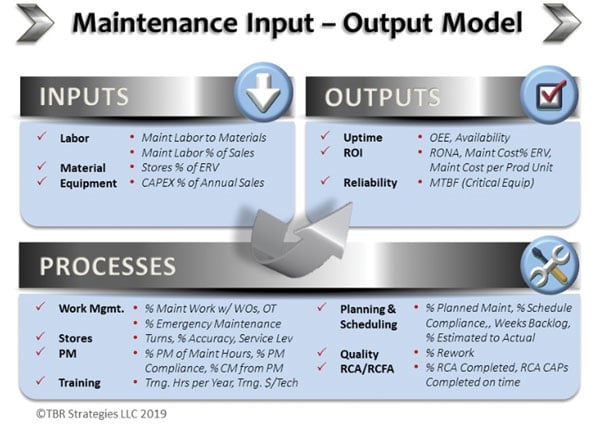

Figure 1 shows the traditional Input-Output Model with the Input categories of Capital, Labor and Materials shown as an input. The KPIs are our feedback loop as to how well the process works. Measures for each, as lagging KPIs, are listed. The processes are maintenance activities and list those leading indicators that show the effectiveness of the conversion of CLM. Finally, outputs are measured by lagging indicators or results.

Inputs

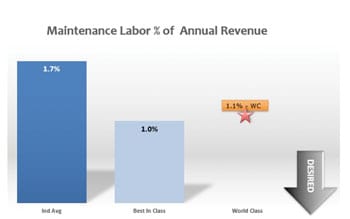

If we start with the Input side, we measure the appropriate level of contributions. For purposes of comparison, the range will show industry averages to Best in Class in the industry. World Class would be across all industries. Industry averages and Best in Class (BIC) are for heavy equipment (construction, waste hauling, etc.). I will illustrate the Inputs with charts showing the comparative ratios, but only for the Input side due to the space 20-plus charts would consume in this article. The first is Maintenance Labor.

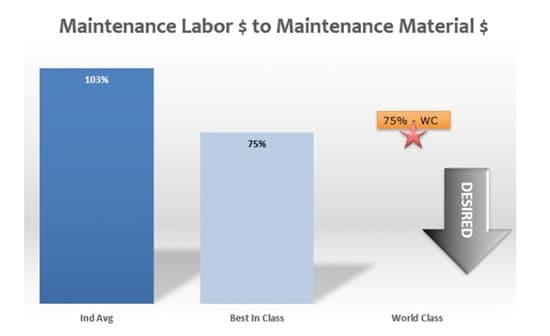

Labor (manpower) is measured with the KPI Maintenance Labor as % of Annual Sales (see Figure 2). Another ratio is the productivity ratio of labor to materials with the KPI Maintenance Labor $ to Maintenance Material $ (see Figure 3). The objective is to maintain balance being somewhere close to a $1.03 for labor to $1.00 for material for an industry average while Best in Class is $.75 labor to $1.00 materials, which indicated higher productivity. Greater labor efficiencies (planning, scheduling, training, oversight, communications) lead to less labor to material ratio. This is not an absolute number because there are places where maintenance labor is extremely high, but it is still a good comparison of Input balance.

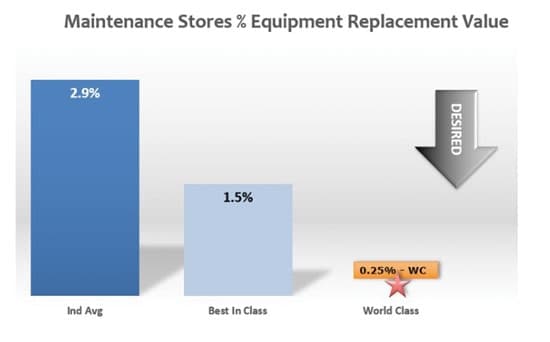

The next ratio on the Input side is Materials (pars and materials). We will use Stores as a % of ERV (Estimated Replacement Value) (see Figure 4, page 16). ERV is a common means to compare various maintenance costs as a relative number. ERV is the expense to replace at today’s costs with like-kind equipment (versus new) or comparable value. Sales is the second most common but due to all the variables leading to sales, this is less significant than the ERV indicator. A more efficient storeroom relies on planning and scheduling and vendor stocking as opposed to storing large amounts of JIC (Just in Case) parts. Low emergency rates for Best in Class and World Class companies mean smaller storerooms and associated costs (holding or carrying costs, expediting costs, etc.).

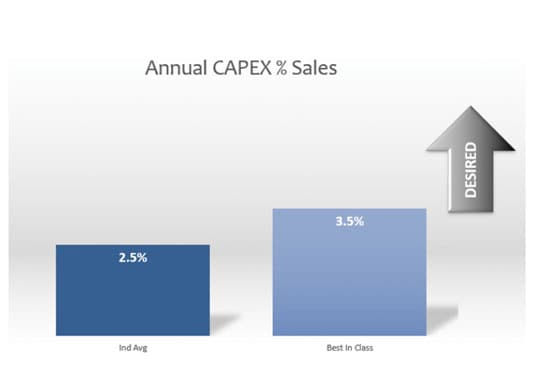

The last input ratio is equipment or capital. The KPI here is the balance of replacement additions each year with the KPI CAPEX as % of Annual Sales (Figure 5, page 16). A good industry average is 2.5 to 3.0 percent of annual sales while Best in Class will be in the range of 3.5 to 4.0 percent. There is too much variance in the World Class numbers due to industry types, so WC is not shown.

Processes

Measuring the processes is determining the effectiveness of converting the Inputs to Outputs. As Figure 1 illustrates, the various maintenance practices or activities include: Work Management, Stores, PM, Training, Planning & Scheduling, Quality and RCA/RCFA. Work Management is measured by the KPI % Maintenance Work Captured on Work Orders with Industry Averages at 90 percent and Best in Class at 100 percent. Also, another Work management ratio is the KPI Overtime, which is 16.5 percent for the industry and 8 percent for BIC. The KPI % EM (Emergency Maintenance) is an excellent indicator of the emergency or high priority work (must be completed within 24 hours). Industry averages are 10 percent with BIC at 4 percent.

Stores are normally measured by the KPIs Turns, Accuracy and Service Level. With Turn rates (total annual disbursements over total annual value) ranging from .5 to 1 for industry average and >2 for BIC. Accuracy (difference between the physical counts and what is in the system) should be around 80 percent for industry and 95 percent for BIC. The last of the Stores KPIs is Service Level, which measures the percent of time stocked items are available compared to the attempts to get them. Industry averages are in the 75to 80 percent range while BIC is 95 percent.

Preventive maintenance KPIs include % PM of Maintenance Hours with 32 percent being industry average and 55 percent being BIC. % PM Compliance is a KPI that measures the success of PMs being done on time (number work orders attempted within a week compared to done within a week). Industry averages are 65 percent compared to 98 percent for BIC. The KPI % CM from PM is the amount of corrective maintenance generated from PMs. The norm here is 20 percent or 1/5th of all PMs generating corrective work.

Training of the technicians/mechanics are measured by hours and investment. The KPI Trng Hrs per Year per Tech is 83 for industry average and 100 for BIC. The KPI Trng $/Technician ranges from $1,000 for industry averages to $1,600 for BIC. Another good way is to look at 5 percent of payroll dollars for training.

Planning and Scheduling is measured with KPIs like % Planned which is 69 percent for industry average and 90 percent for BIC. The KPI % Schedule Compliance (both PM and CM) will range from 70 percent for industry averages and 98 percent for BIC. Weeks Backlog (number of man-weeks sitting in cue of work that has been identified but not yet done) range from three weeks for industry averages to five for BIC. The other KPI for Planning and Scheduling is % Estimated to Actual (job estimation accuracy), which ranges from 20 percent for industry averages to 10 percent for BIC.

The quality indicator (right first time) is tracking the KPIs % Rework (percent of same work redone within 30 days) and the industry average at 10 percent with BIC at 3 percent. The ability to identify root causes to issues to prevent recurrence is critical. The logical means is Root Cause Analysis and eventually Root Cause Failure Analysis. Industry average for RCAs Completed (according to Business Rules) is 80 percent with 95 percent for BIC.

Outputs

Ultimately, how well we converted the Inputs using the Processes is demonstrated in the yields. Typical Outputs would be Overall Equipment Effectiveness (OEE) on stationary equipment. OEE is a universal number that measures availability x performance x quality. Industry averages range from 40 to 60 percent but BIC is 85 percent for Discreet production units and 90 percent for Batch type production.

Availability is the percent of time the equipment is available that it was scheduled. Like OEE, it varies for industry averages from 40 to 60 percent, but the BIC is 90 percent. When it comes to determining Return on Investment, the KPI Return of Net Assets or RONA is universal and ranges between 25 to 30 percent for industry averages with greater than 50 percent for BIC.

Another good lagging indicator to measure the impact of a good maintenance program is using the KPI Maintenance Costs as % of ERV. This will range from 14.5 percent for industry averages to 4 percent for BIC. Maintenance Cost per Production Unit is less of a universal benchmark comparison and more of an internal trend comparison number measuring, ideally, the reduction over time.

Mean Time Between Failure (operating hours divided by number of failures) or MTBF is best monitored for critical (Class A) equipment and the target is a 10 percent reduction from year-to-year. As we can see, the outputs are lagging or result indicators that track the effectiveness and efficiency of how well we converted our Capital, Labor and Materials through the processes into outputs of uptime and costs. What gets measured gets done—what gets measured gets managed.

Monitoring Performance and Cost

In conclusion, having a tight set of leading and lagging indicators allows us to monitor the performance and costs of our maintenance operations with considerably more granularity and precision. It provides us with correct and timely information to help decide to either continue the current course of actions or to change them. Because ultimately, we are responsible for producing maximum uptime at the minimum lowest cost. The question becomes, “How do you know you are?”

With more than 46 years of experience, Preston Ingalls, President/CEO of TBR Strategies (Raleigh, NC), has led maintenance and reliability improvement efforts across 31 countries for a variety of companies. He consults extensively with heavy equipment fleets and the oil and gas industry in the areas of equipment uptime and cost reduction. For more information visit www.tbr-strategies.com.