Developing a pro forma model encompassing the RWA’s projected operational costs and revenues enabled decision-makers to develop timely cash flow projections. Now the RWA has a useful tool for annual budgeting and long-term capital policies.

Marc J. Rogoff and Brooks Stayer

In the six consecutive years prior to 2013/14 fiscal year, the Merced County Regional Waste Management Authority (RWA) in California operated at a deficit despite several disposal rate increases. This trend was the result of the decline in revenue associated with the Great Recession, in combination with several operational inefficiencies including an inadequate unencumbered cash reserve. In addition, the heavy equipment fleet was leased and aging and capacity expansions at both landfill sites would be needed within five years. Old bond debt was $30 million and unfunded closure/post-closure liabilities added another $20 million to the shortfall. In all, the RWA was underwater by $75 million and it would be losing one of its major municipal solid waste customers in 2015.

With a change in management in 2012 came the decision to assess RWA’s operational and administrative functions. Throughout this year-long process, a new Regional Waste Director was selected to implement a progressive strategy that would realize operational efficiencies, cost savings, an expanded customer base and lower long-term debt through bond refinancing. These measures provided considerable benefits, particularly in regards to the long-term financial health of the agency; however, it was uncertain that cash would be generated quickly enough to meet the existing need. As a result, the agency hired a rate consultant in April 2015 to assess the anticipated shortfall and prepare a report to the RWA’s governing board.

Regional Waste Authority Overview

Joint Powers Authority

In April 1972, the County of Merced and the Cities of Atwater, Dos Palos, Gustine, Livingston, Los Banos and Merced entered into a Joint Powers Agreement (JPA) for development of a solid waste authority (RWA) to consolidate solid waste disposal activities. This proved to be visionary when the State of California mandated a perpetual series of recycling goals. Per the JPA, the individual agencies operate, or contract for the operation, of their individual solid waste collection programs. The RWA is responsible for operations and long-term planning of two municipal solid waste landfills along with recycling and household hazardous waste programs within Merced County, which is south of Sacramento.

Landfills

The RWA owns and operates two recycling and disposal facilities, each located near the population centers of Merced County. The larger of the two (creatively named “The Hwy 59” landfill) is located just north of the City of Merced and processes about 290,000 tons/yr. of material (Figure 1) while the smaller Billy Wright landfill (Figure 2) on the eastern slope of the coast mountain range processes 60,000 tons/year.

Capital Improvement Plan

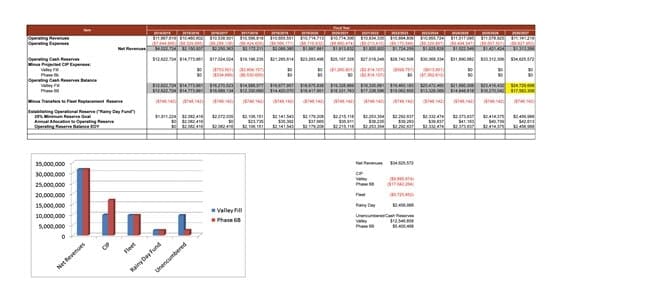

Expansions to increase disposal capacity are needed at each landfill in the coming years (Figure 3). The Billy Wright facility has only one option. As shown in the Capital Improvement Plan in Figure 3, there are two different options for development of the Highway 59 Landfill, the “Valley Fill Project” and construction of the “Phase 6B Project”. The 20-acre Phase 6B was permitted in 1996 and has all of the necessary permits, whereas the Valley Fill is still deep in the environmental review process. If successful, the area between two adjacent phases (the valley) will be used and the topography will be reconfigured to increase the maximum disposal elevation to 360 feet above mean sea level (MSL). This mirrors the existing Phase 6 permitted height and will yield additional volumes. Certain currently permitted onsite operations (grinding and composting, fleet fueling and maintenance shop, as well as recycling and hazardous processing areas) will require relocation.

The RWA is pursuing the Valley Fill option as it will provide up to 6,900,000 yd3 of additional long-term disposal capacity at the site at almost half the cost of constructing 3,200,000 yd3 capacity in Phase 6B. The project would allow for operation of the landfill for an additional 11 to 15 years beyond the limits enumerated in its current solid waste facility permit. Additionally, with implementation of the proposed project, the peak tonnage is anticipated to increase from its currently permitted 1,500 tons/day to approximately 3,000 tons/day by 2035, and the peak traffic volume is anticipated to increase from the currently permitted 554 vehicles/day to approximately 750 vehicles/day in 2030.

At present, the RWA is in the environmental review process and is seeking to obtain necessary approvals and permits. Until the permitting of the Valley Fill is certain, the budget assumes funding will be needed for the more expensive Phase 6B scenario.

The Pro Forma Model

A Pro Forma Model was developed at the outset to help the RWA prepare a long-term cash flow analysis and assess whether or not funds were available from operations to forestall a bond issue for the capital improvements as well as to fund adequate emergency reserves. At the beginning of SCS Engineers’ engagement, RWA staff provided background data and information concerning residential collection revenues and operating expenses. This included the following critical information:

- Staffing and organizational charts

- Wages and benefit rates

- Rate schedules

- Bond debt

- Fund account summaries (totals and comparisons)

- Past and current operating budgets

- Fleet replacement plan

- Waste deliveries and customer records

- Capital improvement plan

- Ordinances and bond statements

- Administrative costs

Rate Model

This model includes the following facets:

- An analysis of operational expenditures (personnel, contract and purchased services, materials and supplies, transfers)

- Analysis of capital outlays (equipment replacement and capital projects)

- Revenue sufficiency analysis (annual revenue projections and rate plan to provide sufficient revenues)

- Funds analysis (reserve requirements, transfers to reserves, administrative costs, beginning and ending fund balances)

- Based on data and information provided by the RWA, these individual spreadsheets were linked to develop an overall model to conduct the assessment analysis.

Methodology Overview

The following methodology was used by SCS to conduct the cost of service analysis:

- Collect Historical Actual Expenses and Revenues for the System—The first task was to gather available historical actual revenue and cost data and include these into a financial database.

- Development of the “Test Year”—The second task was the development of an annual revenue requirement for a “Test Year”. The revenue requirement represents the total revenue for the System to recover during a year to fund all System costs. SCS worked with RWA staff to select a period that reflected a typical year for the System. Actual expenses for FY 14/15 were used as the basis of the Test Year for the Study. SCS then worked with RWA staff to make these costs more representative of anticipated conditions during the upcoming 12-year financial planning horizon. The resulting Test Year was used as the basis for forecasting expenses for the 12-year forecast (FY 15/16 to FY 26/27.)

- Development of a Revenue Requirement Projection—After developing the revenue requirement for the Test Year, SCS worked with RWA staff to project changes in anticipated costs due to inflation, labor increases, facility and vehicle replacement, planning costs, etc. This resulted in a 12-year revenue requirement forecast for the entire system including disposal of solid waste from RWA members and out-of-county waste deliveries.

- Revenue Offsets—SCS worked with RWA staff to develop estimates of any revenue offsets (governmental grants, if any, interest, and LFG sales).

- Operational Cost Savings—SCS worked with RWA staff to develop estimates of any operational savings (pension savings).

- Determination of Waste Tonnage—SCS worked with RWA staff to develop reasonable estimates of waste tonnage over the next 12-year period under various assumptions (low, medium and high growth assumptions) into two categories: in-county/long-term contractual tonnage and cash customers/short-term contracts.

- Calculation of Cash Flow—SCS then distributed the net revenues and cash needs for fleet and capital expenses, and development of a “rainy day fund” (minimum 25 percent of annual operating expenses) to project annual cash reserves.

Development of the Revenue Requirement Projection

In addition to developing the Test Year revenue requirements, SCS forecasted the annual revenue requirement for FY 15/16 to FY 26/27. In order to develop the forecast, SCS projected how operating and capital costs would change over the forecast period due to factors such as inflation. The assumptions used to develop the forecast include the following annual adjustments:

- General—2.3 percent (last 11 years, Federal Reserve Board)

- Solid waste growth—low 0.5 percent; medium 1.5 percent (current RWA trends); and high 2.5 percent (higher out-of-county imports)

- Retirement expense reduction—$135,000 in FY15/16

- Closure and post closure accrual—$75,000 annually

- Beginning unencumbered cash—$14,000,000 (ending FY/14/15 fund balance)

- Annual allocation to Fleet Reserve—$750,000 (current fleet reserve balance minus projected purchases/replacements)

- Landfill tipping fees—$36.52 (RWA members); $22.75 (out-of-county waste imports)

- Methane gas sales—$0 (project not initiated)

- “Rainy Day Fund”—Minimum of 25 percent of annual operational expenses

In addition to forecasting cost increases due to inflation, SCS accounted for the following costs or growth factors over the 12-year forecast as detailed in schedules:

- Capital Improvements—In addition to the costs of operation, the RWA cash reserve was assumed to recover costs for capital improvements to the system, either for the Valley Fill or Phase 6B cell designs. SCS used Capital Improvement Plan cost data provided by the RWA.

- Annual transfer of a projected $750,000 from annual net revenues to the Fleet Reserve Fund.

- Annual transfer of funds needed to achieve a minimum balance in a Rainy Day Fund (25 percent of operating costs).

Key Findings and Recommendations

The Pro Forma Model suggests the following major findings and recommendations:

- Net revenues during the 12-year planning horizon appear to range between $2 and $3 million annually.

- The current debt service is a major drain ($2 to $2.2 million a year) on the RWA’s cash flow until the bonds are defeased in FY 26/27.

- Allocation of funds for projected capital improvements, fleet replacement and a new “Rainy Day Fund” can all be achieved even if the RWA receives low waste deliveries to the landfill. Projected cash reserves are projected to be as follows (see Figure 3):

- $12.5 million for Valley Fill option.

- $5.4 million for Phase 6B option.

- The RWA should consider funding the LFG-E project out of cash reserves rather than bond proceeds. Projected annual revenues for methane sales are $320,000.

Lessons Learned

On October 15, 2015, the RWA adopted the findings of the proposed pro forma model. Conducting the pro forma modeling effort enabled the RWA’s decision-makers to project costs of the various capital, fleet and waste flow options. Key among the lessons learned was the implementation of a “Rainy Day Fund”. This fund provides a long-term financial backstop for unforeseen events in landfill operations that cannot be predicted today. Such items could be groundwater and landfill gas remediation, issues with landfill liners and weather events. The fund is capped at 25 percent of the annual operating costs of the RWA, which can also provide three to four months of operating expenses. While typical of many large County or municipal General Funds, it is less typical of individual enterprise funds in the past. Such Rainy Day Funds are becoming more and more prominent across solid waste agencies in the U.S. Lastly, the RWA has a financial tool that can be updated annually and continue to project future revenues and capital expenditures and, ultimately, more accurately forecast rate needs. | WA

Marc J. Rogoff is a Project Director at SCS Engineers (Long Beach, CA). He is responsible for leading the firm’s financial and economic consulting practice. He has conducted cost of service and rate analysis for more than 50 solid waste collection and landfill programs across the U.S. Marc can be reached at (813) 804-6729 or via e-mail at [email protected].

Brooks Stayer currently serves as Director of the Merced County Regional Waste Management Authority in Merced, CA. He has 20 years of experience in the solid waste industry ranging from collection, recycling, composting, waste-to-energy and landfill disposal. Brooks can be reached at (209) 723-4481 or via e-mail at [email protected].

References

Rogoff, Marc J., Solid Waste Recycling and Processing: Planning of Solid Waste Recycling Facilities and Programs, Second Edition, Waltham, MA, William Andrews/Elsevier, 2014.

Rogoff, Marc, “Analyzing Cost of Service and Designing Rates for Solid Waste Agencies, Kansas City, MO,” American Public Works Association, 2007.

SCS Engineers, Pro Forma Model, RWA Long Term Operations, Prepared for the Merced County Regional Waste Management Authority, October, 2015.

Figures 1 and 2 courtesy of Merced County Regional Waste Management Authority; figure 3 courtesy of SCS Engineers.