The COVID-19 pandemic brought sweeping changes to the U.S., including impacts to the solid waste industry, which was designated as an essential industry and continued to work during the crisis. For some haulers and cities, it has been a time for reinvestment and taking steps to make things work better or to try to create change for the better in the future.

By Marc J. Rogoff and David Biderman

The U.S. has surpassed more than 44 million infections from SARS-CoV-2, a.k.a COVID-19, and more than 700,000 deaths. Globally, cases have risen to 240 million and 4.8 million deaths. A rollout of several vaccines was developed in record time at the end of 2020, with now more than 65 percent of the country 12 or older with at least one dose of the vaccines.

However, distribution and challenges became evident, and the U.S. fell short of its goal of providing an initial dose of the vaccines to 70 percent of all adults by July 4, 2021. A new, more contagious strain of COVID-19 initially identified in England and India, called the Delta variant, became the most prominent recent infection wave throughout the country, and had a very significant impact in the Sunbelt states with low vaccination rates. As we write this article, several states like Alaska, Idaho and Montana have implemented “rationing of care” in their hospitals due to overloaded emergency rooms and ICU beds, as these states deal with unprecedented spikes in cases of COVID-19, primarily from unvaccinated residents.

Labor Impacts

Not unlike other industries, COVID-19 impacted the solid waste industry hard with delayed collection services or the temporary suspension of recycling, yard waste, or bulky waste pickup in some cities and backups at scale houses and MRF facilities, exacerbated by COVID-19 outbreaks among drivers and other workers. For example, at the peak of the pandemic, 20 percent of the New York Department of Sanitation workforce was out, with at least eight deaths in its ranks. These challenges came as collectors had to deal with a greater volume of trash from residences, including all of the disposable masks, gloves, restaurant takeout waste, online packaging wastes, bulky wastes and wastes from home construction projects undertaken by residents who had more time at home to begin new projects. The City of Philadelphia reported a 30 percent increase in curbside collection volumes.

All of these waste volume increases caused collection routes to often be overwhelmed with drivers heading to a disposal facility earlier, prolonging the shifts in an understaffed situation. Late or missed pickups have lit up local TV and social media with mountains of complaints. Layered onto the pandemic staffing issues is a growing national shortage of commercially licensed drivers, straining the

ability of municipalities and haulers to keep up with the trash and recyclables pickup.

While people have complained about delayed collection in the past, pandemic-related waste woes are far from unique to a growing area such as Hillsborough County, FL, as shown in the flyer sent by Waste Connections of Florida to its customers (see Figure 1). The flier identifies some of the many programs that Waste Connections has had to undertake due to these challenges to mitigate service disruptions and ensure continuity of service. These include job fairs, bringing in employees from affiliated companies, $5,000 retention bonuses, immediate $2.00 per hour wage increases and weekly $125 weekly bonuses to supervisory employees. Many private and municipal haulers have also initiated campaigns to increase awareness of the vaccines. For example, Casella held a lottery in which it awarded five $1,000 prizes to workers that had registered that they had been vaccinated. Cities like Atlanta recently started a program that includes a $500 signing bonus amid their staffing shortfalls.

Others have increased pay and launched in-house, paid CDL training programs to help retain employees. Other communities, including Boston, San Francisco, Tampa, and Tucson, implemented regulations requiring vaccination or frequent testing for city employees. Given the controversy over masking policies and vaccination hesitancy, it is hard to say how this will impact staffing woes.

Mergers and Acquisition

There has been an increase in mergers and acquisitions over the past 18 months, with both large companies and private equity firms purchasing solid waste companies. Waste Management’s (WM) late 2020 purchase of Advanced Disposal, which at the time was the fourth largest solid waste company in the U.S., with well over $1 billion in annual revenue, resulted in a cascade of additional transactions. Concerned about monopolization in certain markets, the Justice Department conditioned WM’s acquisition on its divesting of certain assets in about a dozen markets. GFL, which purchased WCA (itself the 10th largest solid waste company in the country), in late 2020, acquired the divested assets. Subsequently, it has sold some of those assets to Noble Environmental, a growing PA-based company. GFL has also sold some of the assets in the Midwest to LRS (formerly Lakeshore Recycling Systems). LRS has grown rapidly in recent years, including a string of acquisitions this year.

In addition, several of the leading family-owned, privately-held companies in the industry have recently been sold. In New England, E.L. Harvey & Sons, Inc., the largest private company in the region, was recently acquired by Waste Connections. In the Midwest, Peoria Disposal was purchased by GFL in September 2021. Both companies had at least three generations of family members who had worked for them.

Although there is often a healthy amount of transactional activity in the solid waste industry, the current uptick in acquisitions is noteworthy. It is likely being caused by a number of factors, including: (1) high valuation of the assets due to multiple potential purchases, (2) low interest rates, which make it less expensive to borrow money to buy other companies, (3) pandemic fatigue, (4) expectations that capital gains tax rates will be increasing soon and (5) lack of a successor in the family to run the business. We expect a high level of acquisitions activity to continue through the remainder of 2021 and into 2022.

New Equipment and Replacement Parts

The COVID-19 pandemic has posed significant challenges to supply chains globally. Multiple local and regional lockdowns continue to slow or temporarily stop the flow of raw materials and finished goods, disrupting manufacturing. As of this writing, there are some 65 cargo ships that have been forced to queue outside the Ports of New York, Los Angeles, and Long Beach (more than 40 percent of the cargo containers entering the U.S.) due to surging demand for imports as the U.S. economy has reopened (see Figure 2). However, the global shipping market is struggling to keep up.

Waste haulers and solid waste directors who have recently attempted to order a new garbage truck, metal dumpster or roll-offs have learned that COVID-related backlogs have made timely delivery of a new refuse vehicle nearly impossible. Truck manufacturers, garbage chassis companies and virtually the entire supply chain are experiencing unprecedented backlogs, resulting in delivery time frames that can exceed eight to 12 months or more. The expectation by most observers is that total truck production over the next few years will be cut. To compound matters, garbage truck and body manufacturers have been forced to prioritize the fulfillment of contractual obligations to large accounts, pushing new or smaller hauler orders even farther down the production line.

Recycling Markets

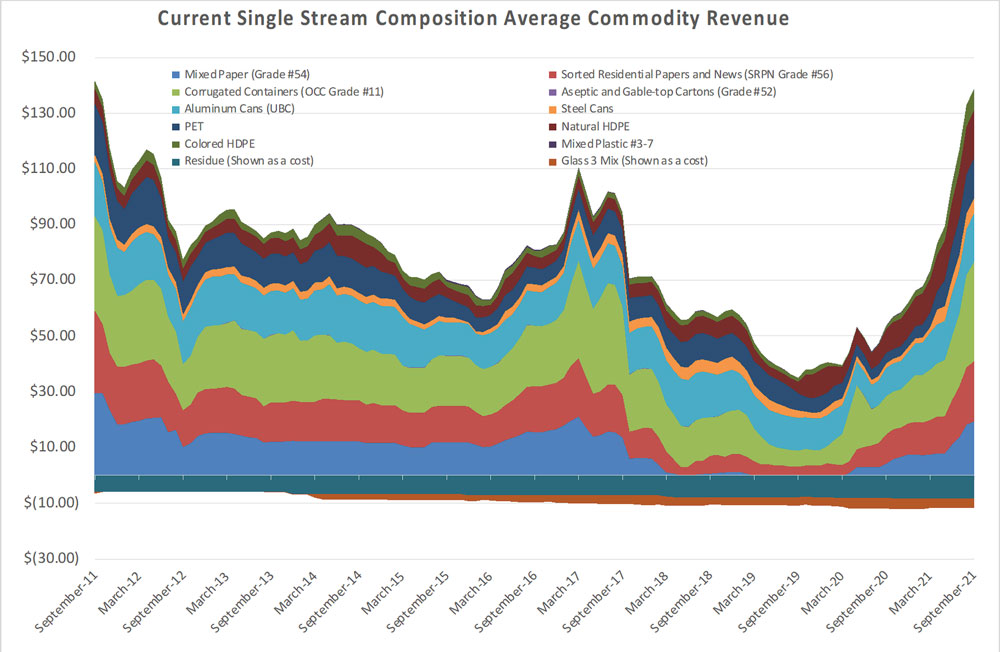

There are some bright spots to the COVID-19 pandemic. Sellers of recyclable materials have continued to enjoy strong markets over the last year with most grades of fiber, plastics and metals seeing markedly higher average commodity prices. The largest publicly traded haulers in North America—Casella, GFL, Republic, Waste Connections and Waste Management—all recently reported double-digit increases in recycling revenues during the second quarter of 2021. For example, Waste Management reported receiving an average of $100 a ton for recovered commodities during the second quarter of 2021, up from $57 a ton a year earlier. The value of discarded cardboard, a significant component of what is processed at a MRF, has increased from about $30 per ton in early 2020 to more than $150 in Fall 2021. Most of the MRFs that suspended operations due to labor shortages earlier in the pandemic have reopened.

Figure 3 is a 10-year compilation of recyclables pricing/revenues per ton on an “apples-to-apples” comparison. To reduce labor costs and produce cleaner bales of recyclables, a growing number of companies are investing in extensive renovations of some facilities, installing optical sorters and employing artificial intelligence (AT). There is also a move afoot by private haulers to “de-risk” their recycling business by shifting to a “fee-for-service model”, which has helped lift their operating margins and created a more sustainable business model. Further, recovered fiber and plastic exports to India, Thailand and Vietnam have increased significantly during 2021 and development of new U.S.- based markets has helped temper the impact of China’s National Sword import restrictions.

Safety

Another bright spot resulting from the pandemic has been an improvement in the solid waste industry’s overall safety performance. Solid waste collection has been the fifth or sixth most dangerous

occupation in the U.S. in recent years, according to the federal Bureau of Labor Statistics (BLS). However, data collected by SWANA suggests a decline in 2020 in the frequency of workplace fatalities in the industry, and that decline has continued into 2021. There continues to be an elevated number of accidents involving third-party vehicles. The BLS will be releasing its report on occupational fatalities for 2020 in December 2021, and SWANA will evaluate the data and issue a summary/analysis.

Another safety issue that is receiving increased industry attention in recent years has been the increase in fires at recycling facilities. According to one estimate, there is about one fire every day at a U.S. recycling facility. Many industry experts point to the proliferation of lithium-ion batteries as the culprit, although other flammable materials in the waste stream, including propane tanks, are also contributing to these fires. EPA issued a report in July 2021 on the proliferation of fires in waste management and recycling facilities that has (pardon the pun), added fuel to the fire.

The Future

The COVID-19 pandemic brought sweeping changes to the U.S., including impacts to the solid waste industry, which was designated as an essential industry and continued to work during the crisis. For some haulers and cities, it has been a time for reinvestment and taking steps to make things work better or to try to create change for the better in the future. If ever there was a time to improve resiliency in solid waste systems, the time is now. Due to climate change, there will be more flooding, stronger and more frequent storms, and more extreme heat. We believe that the solid waste industry will be up to these challenges. | WA

Dr. Marc J. Rogoff is a Senior Consultant with Geosyntec Consultant’s Solid Waste Advisory Practice (Tampa, FL). He can be reached at (813) 810-5547 or e-mail [email protected].

David Biderman is the Executive Director and CEO of SWANA, the Solid Waste Association of North America (Silver Spring, MD). He can be reached at (240) 494-2254 or e-mail [email protected].

References

Bob Costello and Alan Karickhoff, “Truck Driver Shortage Analysis”, 2019, American Trucking Association.

Beth Harvilla, “Rumpke’s Columbus Plant Seeing More Fires Because People Put Batteries in the Recycling,” The Columbus Dispatch, Sept. 21, 2021.

Jacob Paben, “People Problem”, Resource Recycling, September 2021.

Jacob Paben, “Stronger Markets Lift Recycling Revenues for Major Haulers”, Resource Recycling, August 2021.

Maria Rachal, “Waste Industry Monitors Service Disruptions Amid Spread of Variant”, Waste Dive, August 16, 2021.

Solid Waste Association of North America, “SWANA Address Current Labor Shortage in Solid Waste Collection Services, May 2021

U. S. Environmental Protection Agency, Office of Resource Conservation and Recovery, “An Analysis of Lithium-Ion Battery Fires in Waste Management and Recycling,” July 2021.